A balance transfer or personal loan is an option if you are trying to repay your credit card debt. Personal loans offer more structure and flexibility, while balance transfers are more flexible. Each option has its own fees. You should determine which option is right for you before applying. You should know the interest rate and other requirements before applying for a balance transfer or personal loan.

Pay off high-interest credit card debt with a balance transfer card

Both personal loans and balance transfer cards can be used to pay off high-interest debt. However, you need to take into account certain factors before making a decision. Your financial situation is the first. You can pay your debt off over time with a balance transfer creditcard, while a personal mortgage requires monthly fixed payments. It is important to carefully compare each option and the monthly payments. Before making a decision on which option to choose, you might want to look at your credit score.

Pay off high-interest credit card debt with a personal loan

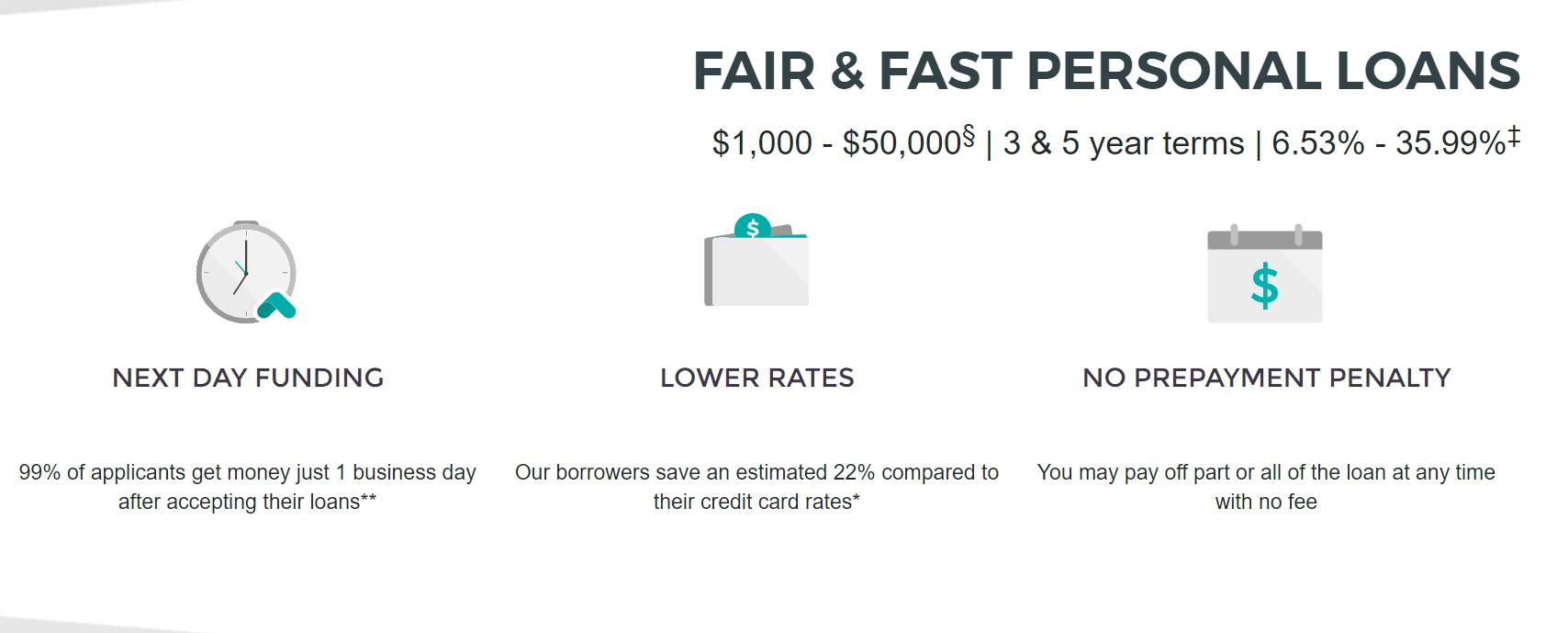

A personal loan is a good option to repay high-interest credit card debt. These loans are a great way to consolidate debt, receive lower interest rates, and have many repayment options. To get a realistic view of your debts, review them before applying for a personal loan. Make a spreadsheet with your monthly payments and current balances. You can use this spreadsheet to find a lower rate balance transfer. This is the simplest way to save money while still paying off your debt.

Personal loans and balance transfers have interest rates of 4%

Both personal loans and balance transfer can be used to consolidate debt, and lower interest rates. A balance transfer credit card lets you make over payments while a personal loan requires a fixed monthly payment. Consider your budget and whether the amount you can afford to pay the balance in the promotional period before deciding which option to choose. Compare the monthly payments for personal loans and balance transfers.

Application for a balance-transfer card

Balance transfer cards and personal loans can be a great option if you are trying to repay credit card debt. Fixed repayment amounts and lower interest rates are some of the benefits offered by these credit cards. Both options can be used to clear your debt. Before proceeding, it is important to carefully read and understand the terms of the loan agreement.

Personal loans at interest

It's important to be aware of the differences in interest rates for personal loans or balance transfers. While balance transfer loans are best for those with good credit, unsecured personal loans can be a good option for consumers with lower credit scores. These loans provide borrowers with the ability to choose repayment terms as well as higher borrowing amounts. An Experian survey shows that 26% of consumers are using personal loans for debt consolidation. This is when multiple debts are combined into one lower interest payment. A low-interest personal loan can be an ideal tool for paying off credit card balances.

Repayment periods

Whether you're considering a balance transfer or personal loan, the choice is an important one. Both offer different benefits. A personal loan is a fixed-rate, monthly payment option, unlike a credit card that offers variable interest rates. The personal loan can be approved for a larger amount. Before making your decision, consider your financial situation and your ability to pay off the debt during the promotional period.

Transfer cards with balances at a lower interest rate

A balance transfer credit card is a good option if you have credit card debt. These cards can often be offered with a 0% intro period that could save you hundreds of bucks each month. However, interest rates will rise after the initial period.

FAQ

What is personal finance?

Personal finance is about managing your own money to achieve your goals at home and work. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You won't have to worry about paying rent, utilities or other bills each month.

Not only will it help you to get ahead, but also how to manage your money. You'll be happier all around. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

So, who cares about personal financial matters? Everyone does! Personal finance is a very popular topic today. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. There are only two hours each day that can be used to do all the important things.

If you are able to master personal finance, you will be able make the most of it.

How can a beginner earn passive income?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You may have some ideas. If you do, great! If not, you should start to think about how you could add value to others and what you could do to make those thoughts a reality.

Online earning money is easy if you are looking for opportunities that match your interests and skills.

There are many ways to make money while you sleep, such as by creating websites and apps.

Writing is your passion, so you might like to review products. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. That way, you'll stick with it long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

This can be done in two ways. You can either charge a flat fee (like a freelancer) or you can charge per project (like an agent).

In each case, once your rates have been set, you will need to promote them. It can be shared on social media or by emailing your contacts, posting flyers, and many other things.

These three tips will help you increase your chances for success when marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. You never know who will be reviewing your content.

-

Know what you're talking about - make sure you know everything about your topic before you talk about it. A fake expert is not a good idea.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. Send a recommendation directly to anyone who asks.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Learn and keep growing as a marketer to stay relevant.

What is the fastest way to make money on a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. It is important to establish a good reputation online as well offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. It is important to consider how you can help the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

If you are careful, there are two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has its pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow your business without worrying about shipping products or providing services. It takes more time to become an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. This can take some trial and error. It pays off in the end.

How much debt is considered excessive?

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much can you afford? There is no universal number. However, the rule of thumb is that you should live within 10%. That way, you won't go broke even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. Spend less than $2,000 per monthly if you earn $20,000 a year. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

The key here is to pay off debts as quickly as possible. This includes student loans, credit cards, car payments, and student loans. When these are paid off you'll have money left to save.

You should also consider whether you would like to invest any surplus income. You could lose your money if you invest in stocks or bonds. If you save your money, interest will compound over time.

Let's take, for example, $100 per week that you have set aside to save. That would amount to $500 over five years. Over six years, that would amount to $1,000. You would have $3,000 in your bank account within eight years. When you turn ten, you will have almost $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. It's impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. If you don't do this, you may end up spending far more than you originally planned.

How do wealthy people earn passive income through investing?

There are two ways you can make money online. One way is to produce great products (or services) for which people love and pay. This is called "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is known as "passive income".

Let's imagine you own an App Company. Your job is to create apps. You decide to make them available for free, instead of selling them to users. It's a great model, as it doesn't depend on users paying. Instead, you rely upon advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how successful internet entrepreneurs today make their money. They are more focused on providing value than creating stuff.

What is the distinction between passive income, and active income.

Passive income is when you earn money without doing any work. Active income requires work and effort.

When you make value for others, that is called active income. If you provide a service or product that someone is interested in, you can earn money. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great because it allows you to focus on more important things while still making money. Most people don't want to work for themselves. They choose to make passive income and invest their time and energy.

The problem with passive income is that it doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

You also run the risk of burning out if you spend too much time trying to generate passive income. So it's best to start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to Make Money Online with No Experience

There are many different ways to make money online. Some people prefer using their computers to do work, while others prefer being outside to meet new people.

No matter what your personality is, there are always ways to improve. This article will show you how to make your life easier.

Since its inception, blogging has seen a tremendous growth. Anyone can have a blog, and anyone with a computer is able to make money.

A blog is free and very easy to setup. A domain name and hosting services are all you will need if you don't have any knowledge about blogging.

Selling photos online can be one of the most lucrative ways to make an online income. It doesn’t matter how skilled you are with a camera.

A decent image editing program such as Adobe Photoshop Elements and a high-quality digital camera are all you need. Once you have those items, you are able to upload your images to Fotolia, where millions of people visit every day to download high-quality photographs.

You can sell your skills if you are skilled in a particular area. Whether you're great at writing articles or speak several languages fluently, there are plenty of places online where you can sell your expertise.

Elance is a site that connects freelancers and businesses looking to hire them. People post projects they need help completing, and freelancers bid on them. The project is awarded to the highest bidder.

-

Make an ebook and sell it on Amazon

Amazon is the biggest e-commerce website on the Internet. They provide a marketplace for people to buy and sell products.

This allows you to create an ebook and make it available through Amazon. This is a great option as you get paid per sale, not per page.

You can also teach abroad and earn extra money without having to leave your country. Teachers Pay Teachers allows you to connect with teachers who are looking for English lessons.

You can teach any subject including math, science and geography.

-

Google Write Adsense is another popular way to advertise on your website. Place small ads throughout your website pages when someone visits your site. These ads will be displayed to visitors when they view a particular page.

You will earn more revenue the more traffic you get.

Digitally, you can also sell artwork. Many artists use sites like Etsy to list and sell their artwork.

Etsy makes it easy to create virtual shops that look just like real ones.

Students are becoming more interested in freelance work. As the economy continues to improve, more companies are outsourcing jobs to independent contractors.

It's a win/win situation for both employees as well as employers. Employers save money since they no longer have to pay benefits or payroll taxes. Employees gain flexibility in their schedules and an increase in income.