A collection agency can be a great help in collecting a debt from a customer, but there are some things you should know before hiring one. You should first ensure that the agency has a valid license and is bonded. You can also verify references. The second thing you need to be certain of is that the collectors can negotiate well.

Licensing

Before you can work as a debt collection agent, you need to be licensed in your state. Most states require licensed agencies to have a resident manager and a physical office, and many require a bond against loss. The application fee for a license can vary from one state to the next. It can cost up to $1500 depending on which state you are applying. Licenses in most states must be renewed every year or bi-annually. A failure to renew a license on a regular basis can result in civil or criminal penalties. This license is constantly under revision, so it is crucial to ensure that your collection agency is current.

The requirements for obtaining licenses will vary depending on the state where you live, and the type or agency that you intend to run. You will need to have a bond if there are more than one location. A bond is an important way for clients to be protected and to make sure you adhere to state regulations. It can also prevent any headaches down the road.

Bonding

You will need to submit a bond to the state if your plan is for a collection agency. These bonds are established at the state level and are determined based on your business' financials and credit rating. A Bonding Services agent can help you apply for bonding. There are many agencies available in New York.

A collection agency bond is required to protect the rights of clients and ensure the agency's legal operations. In the event that a collection agency fails to obtain a bail, it can be sued for violating state regulations. A bond can also be used as a defense against harassment or inappropriate threats to collect debt. The requirements for collection agency bonding vary by state. They can be found in the state license directory when you apply.

Cost

There are many factors that will affect the cost of a collection agency bail. The first is the legal precedent in each state that the agency is licensed. Second, the bond amount will be determined by these factors. The amount of insurance coverage for surety will also vary. Premiums for higher levels of insurance will be more expensive. The third aspect is that the bond cost for a collection agency bond can also be affected by the debt collector's credit history and past experience.

You should also consider whether the agency charges a flat rate of a contingency fees. The fees charged in many cases are based on a percentage amount of the recovered sums. But it is important that you remember that not all debts will be easy to collect. A small account will cost more to pursue than one with a large balance.

Credit scores and their effects

A collection agency can have a dramatic impact on your credit score. One missed payment to a collection agency can lead to a downgrade of 110 points. A second missed payment could cause a drop of 115 points. There are many factors that affect the impact of a collection agency on credit scores.

The most important factor is the time since the debt became delinquent. The longer the debt has been in arrears, the worse the impact. However, even a 90-day late payment can have a negative effect on your score.

FAQ

What side hustles will be the most profitable in 2022

It is best to create value for others in order to make money. If you do it well, the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. When you were little, you took your mommy's breastmilk and it gave you life. When you learned how to walk, you gave yourself a better place to live.

You will always make more if your efforts are to be a positive influence on those around you. Actually, the more that you give, the greater the rewards.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In actuality, Earth is home to nearly 7 billion people right now. That means that each person is creating a staggering amount of value daily. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. This is a lot more than what you earn working full-time.

Let's say that you wanted double that amount. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every single day, there are millions more opportunities to create value. This includes selling ideas, products, or information.

Although our focus is often on income streams and careers, these are not the only things that matter. Helping others to achieve their goals is the ultimate goal.

If you want to get ahead, then focus on creating value. My free guide, How To Create Value and Get Paid For It, will help you get started.

How can a novice earn passive income as a contractor?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You might even already have some ideas. If you do, great! If you do, great!

You can make money online by looking for opportunities that match you skills and interests.

There are many ways to make money while you sleep, such as by creating websites and apps.

You might also enjoy reviewing products if you are more interested writing. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever your focus, choose something you are passionate about. If you enjoy it, you will stick with the decision for the long-term.

Once you've found a product or service you'd enjoy helping others buy, you'll need to figure out how to monetize it.

There are two main options. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In each case, once your rates have been set, you will need to promote them. It can be shared on social media or by emailing your contacts, posting flyers, and many other things.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

Be a professional in all aspects of marketing. You never know who may be reading your content.

-

Know what you're talking about - make sure you know everything about your topic before you talk about it. Fake experts are not appreciated.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. Do not send out a recommendation if someone asks.

-

Make sure you have a reliable email provider. Yahoo Mail and Gmail are both free and easy-to-use.

-

You can monitor your results by tracking how many people open your emails, click on links and sign up to your mailing lists.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Ask your family and friends for feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Learn and keep growing as a marketer to stay relevant.

How much debt is too much?

There is no such thing as too much cash. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much do you consider too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. You should not spend more than $2,000 a month if you have $20,000 in annual income. If you earn $50,000, you should not spend more than $5,000 per calendar month.

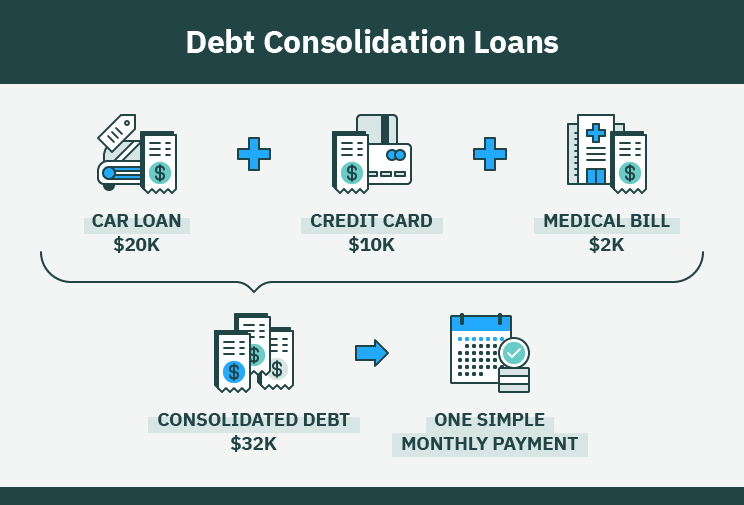

It is important to get rid of debts as soon as possible. This includes credit card bills, student loans, car payments, etc. You'll be able to save more money once these are paid off.

It is best to consider whether or not you wish to invest any excess income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. This would add up over five years to $500. After six years, you would have $1,000 saved. You would have $3,000 in your bank account within eight years. You'd have close to $13,000 saved by the time you hit ten years.

Your savings account will be nearly $40,000 by the end 15 years. Now that's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, your net worth would be more than $57,000.

It is important to know how to manage your money effectively. Otherwise, you might wind up with far more money than you planned.

What is the fastest way you can make money in a side job?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

You need to be able to make yourself an authority in any niche you choose. That means building a reputation online as well as offline.

Helping people solve problems is the best way build a reputation. It is important to consider how you can help the community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many ways to make money online.

You will see two main side hustles if you pay attention. The first involves selling products or services directly to customers. The second involves consulting services.

Each method has its own pros and con. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. You will also find fierce competition for these gigs.

Consulting allows you to grow your business without worrying about shipping products or providing services. However, it takes time to become an expert on your subject.

You must learn to identify the right clients in order to be successful at each option. It will take some trial-and-error. But in the long run, it pays off big time.

Why is personal financing important?

If you want to be successful, personal financial management is a must-have skill. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

So why do we put off saving money? What is the best thing to do with our time and energy?

Yes and no. Yes because most people feel guilty about saving money. Because the more money you earn the greater the opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Financial success requires you to manage your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Unrealistic expectations may also be a factor in how much you will end up with. This could be because you don't know how your finances should be managed.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

How to make passive income?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

That means understanding their needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

Then you have to figure out how to convert leads into sales. Finally, you must master customer service so you can retain happy clients.

Although you might not know it, every product and service has a customer. Knowing who your buyer is will allow you to design your entire company around them.

A lot of work is required to become a millionaire. A billionaire requires even more work. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

And then you have to become a millionaire. And finally, you have to become a billionaire. The same goes for becoming a billionaire.

How do you become a billionaire. It starts by being a millionaire. You only need to begin making money in order to reach this goal.

Before you can start making money, however, you must get started. Let's discuss how to get started.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to make money while you're asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means learning to do more than wait for someone to click on your link or buy your product. It is possible to make money while you are sleeping.

This means you must create an automated system to make money, without even lifting a finger. Automation is a skill that must be learned.

It would help if you became an expert at building software systems that perform tasks automatically. You can then focus on making money, even while you're sleeping. Automating your job can be a great option.

This is the best way to identify these opportunities. Start by listing all of your daily problems. Consider automating them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. Now you need to choose which is most profitable.

A website builder, for instance, could be developed by a webmaster to automate the creation of websites. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

If you have a business, you might be able to create software that allows you manage multiple clients simultaneously. There are hundreds to choose from.

You can automate anything as long you can think of a solution to a problem. Automating is key to financial freedom.