Lowering credit card interest rates can be difficult. Your first contact may not always be the best. Even if you have a great payment history, the person you speak to may not have the power to change your interest rate. Be sure to stress your exceptional customer service and excellent payment history. You must also mention any other offers.

Alternatives to credit card interest rates that are lower

There are several options available to you in order negotiate a lower credit card rate. First of all, make note of your current APR, how often you use the card, and how much you typically charge. This information will make it easier to negotiate your loan terms with the lender. Note any other cards having lower APRs. This will remind your lender to move your business to another bank if they refuse to lower your rate.

A lower interest rate may be available if you pay the entire balance each month. Rate decrease requests can be granted by different credit card issuers. They also consider your credit history in deciding if you should receive a rate reduction.

Alternatives to lower credit card interest charges

People who wish to lower their credit card interest rates have many options. You can first call your credit cards issuer and explain why a lower interest rate is desired. Your credit history and credit score should be mentioned. It is also a good idea to mention that your current interest rate is lower.

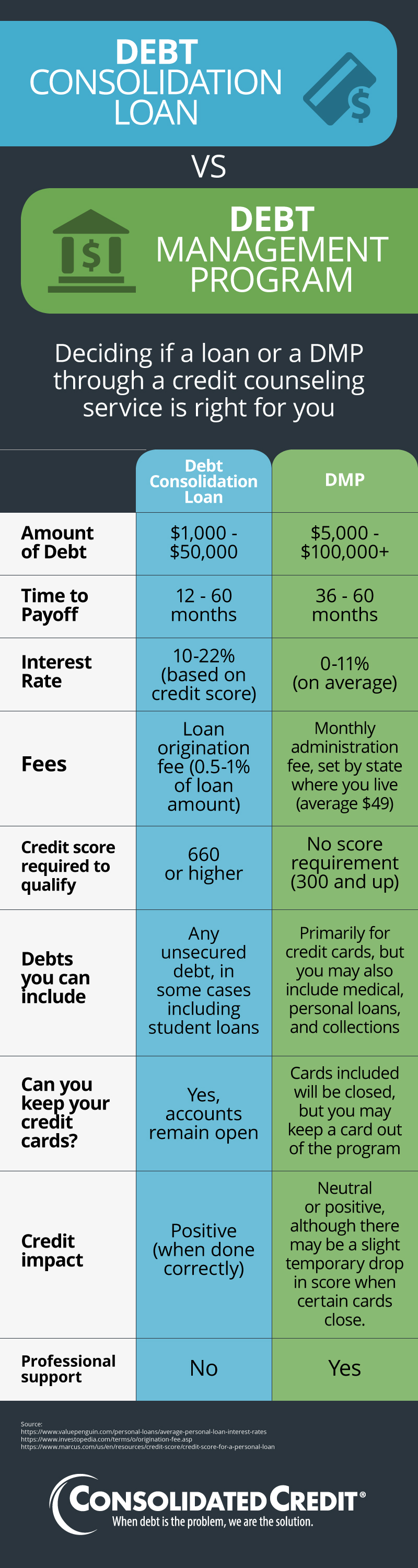

Consolidating your creditcard balances is an alternative. These two options will reduce your monthly payments and lower your interest rates. In many cases, these methods do not affect your credit score. Some consolidation methods might result in an inquiry to your credit report. An additional credit card can be offered to you in order to get lower rates.

Surprised to discover that your credit union will likely lower your rates if your request is made. Although these strategies aren't foolproof, they can help save you money over a year. This process may take only 15 minutes, and you might even get a lower interest rate.

Other options to reduce credit card interest rates are making on-time payments

Paying your credit card on time can lower your interest rate. This will help you save money and reduce your debt. This is an important step because defaulting on your loan can leave a mark on your credit report for years.

Talking to your credit card companies about lowering your interest rate can be another way. These companies are well-known for lowering clients' interest rates by lowering their minimum monthly payment. Some of these negotiation tactics will not affect your credit score, while others may require inquiries.

Credit card companies don't have to lower your interest rate by law, but they can do so if you ask. Compare your current rate against other interest rates. You can request more information from your credit card company if your request is denied. If you do not get an instant reduction, you may have to wait for a longer period of time and make more on-time payments until your interest rate drops.

FAQ

Why is personal finance important?

A key skill to any success is personal financial management. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

Why should we save money when there are better things? Is there something better to invest our time and effort on?

The answer is yes and no. Yes, as most people feel guilty about saving their money. It's not true, as more money means more opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Unrealistic expectations may also be a factor in how much you will end up with. This is because your financial management skills are not up to par.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting means putting aside a portion every month for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What's the best way to make fast money from a side-hustle?

You can't just create a product that solves someone's problem to make quick money if you want to really make it happen.

It is also important to establish yourself as an authority in the niches you choose. That means building a reputation online as well as offline.

The best way to build a reputation is to help others solve problems. You need to think about how you can add value to your community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are many opportunities to make money online. But they can be very competitive.

When you really look, you will notice two main side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each method has its own pros and con. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow your business without worrying about shipping products or providing services. However, it can take longer to be recognized as an expert in your area.

You must learn to identify the right clients in order to be successful at each option. This takes some trial and errors. But in the long run, it pays off big time.

How can a beginner make passive money?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You may even have a few ideas already. If you do, great! However, if not, think about what you can do to add value to the world and how you can put those thoughts into action.

Finding a job that matches your interests and skills is the best way to make money online.

For example, if you love creating websites and apps, there are plenty of opportunities to help you generate revenue while you sleep.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. It will be a long-lasting commitment.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main ways to go about this. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In both cases, once you have set your rates you need to make them known. It can be shared on social media or by emailing your contacts, posting flyers, and many other things.

To increase your chances of success, keep these three tips in mind when promoting your business:

-

You are a professional. When you work in marketing, act like one. You never know who will review your content.

-

Know what you're talking about - make sure you know everything about your topic before you talk about it. No one wants to be a fake expert.

-

Emailing everyone in your list is not spam. For a recommendation, email it to the person who asked.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results. You can track who opens your messages, clicks links, or signs up for your mail lists.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Different strategies can be tested - test them all to determine which one works best.

-

You must continue learning and remain relevant in marketing.

Which side hustles are most lucrative?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles can also be a great way to save money for retirement, have more time flexibility, or increase your earning potential.

There are two types side hustles: active and passive. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Some of the active side hustles are tutoring, dog walking and selling eBay items.

The best side hustles make sense for you and fit well within your lifestyle. A fitness business is a great option if you enjoy working out. You might consider working as a freelance landscaper if you love spending time outdoors.

There are many side hustles that you can do. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you're an experienced writer so why not go ghostwriting?

Be sure to research thoroughly before you start any side hustle. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles can't be just about making a living. Side hustles can be about creating wealth or freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

How do rich people make passive income?

There are two options for making money online. One is to create great products/services that people love. This is called "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is what we call "passive" or passive income.

Let's assume you are the CEO of an app company. Your job is developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. Because you don't rely on paying customers, this is a great business model. Instead, your advertising revenue will be your main source.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is how successful internet entrepreneurs today make their money. They are more focused on providing value than creating stuff.

Which passive income is easiest?

There are tons of ways to make money online. But most of them require more time and effort than you might have. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is affiliate marketing. There are lots of resources that will help you get started. Here are 101 affiliate marketing tips and resources.

As another source of passive income, you might also consider starting your own blog. You'll need to choose a topic that you are passionate about teaching. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many online ways to make money, but the easiest are often the best. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known content marketing.

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to make money while you're asleep

Online success requires that you learn to sleep well while awake. This means more than waiting for someone to click on the link or buy your product. Make money while you're sleeping.

This requires you to create an automated system that makes money without you having to lift a finger. Automating is the key to success.

It would be beneficial to learn how to build software systems that do tasks automatically. This will allow you to focus on your business while you sleep. You can even automate yourself out of a job.

The best way to find these opportunities is to put together a list of problems you solve daily. Then ask yourself if there is any way that you could automate them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. Now you need to choose which is most profitable.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. If you are a designer, you might be able create templates that automate the creation of logos.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are hundreds of options.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is the key to financial freedom.