There are many ways to stop a judgment for credit card debt. You can contact the creditor to attempt to reach a compromise. You can also check with court to confirm that the judgment has been fulfilled. An alternative option is to answer the lawsuit.

Negotiating a settlement between creditors

You should take into account several things when you negotiate a settlement with creditors in order to stop a credit-card judgment. You must first assess your current debt situation. Secondly, you must be willing to communicate with your creditors. You must be ready to make a formal request of each creditor. Also, you should have your agreement in writing. You should make the payments on time and follow up with creditors once you have reached an agreement.

Remember to offer less than the full amount of your outstanding debt. You should try to offer less than half of your total debt so you can negotiate. Also, make sure that you write down the maximum monthly payment you are willing to make. You shouldn't promise to pay more than you can afford. Otherwise, you might default on your debt settlement agreement.

Checking with the court that a satisfied judgment has been filed

There are several things you can do to stop a judgment against credit card debt. First, file a declaration of satisfaction of judgment at the court. The form can be obtained at the court clerk's office. Once it is filed, the clerk will record it in the court's records. Next, you must send a certified letter to the court notifying the court that you have satisfied the judgment. This letter must be submitted within 14 days. You may be held responsible to up to $50 plus damages if this is not done within the time limit.

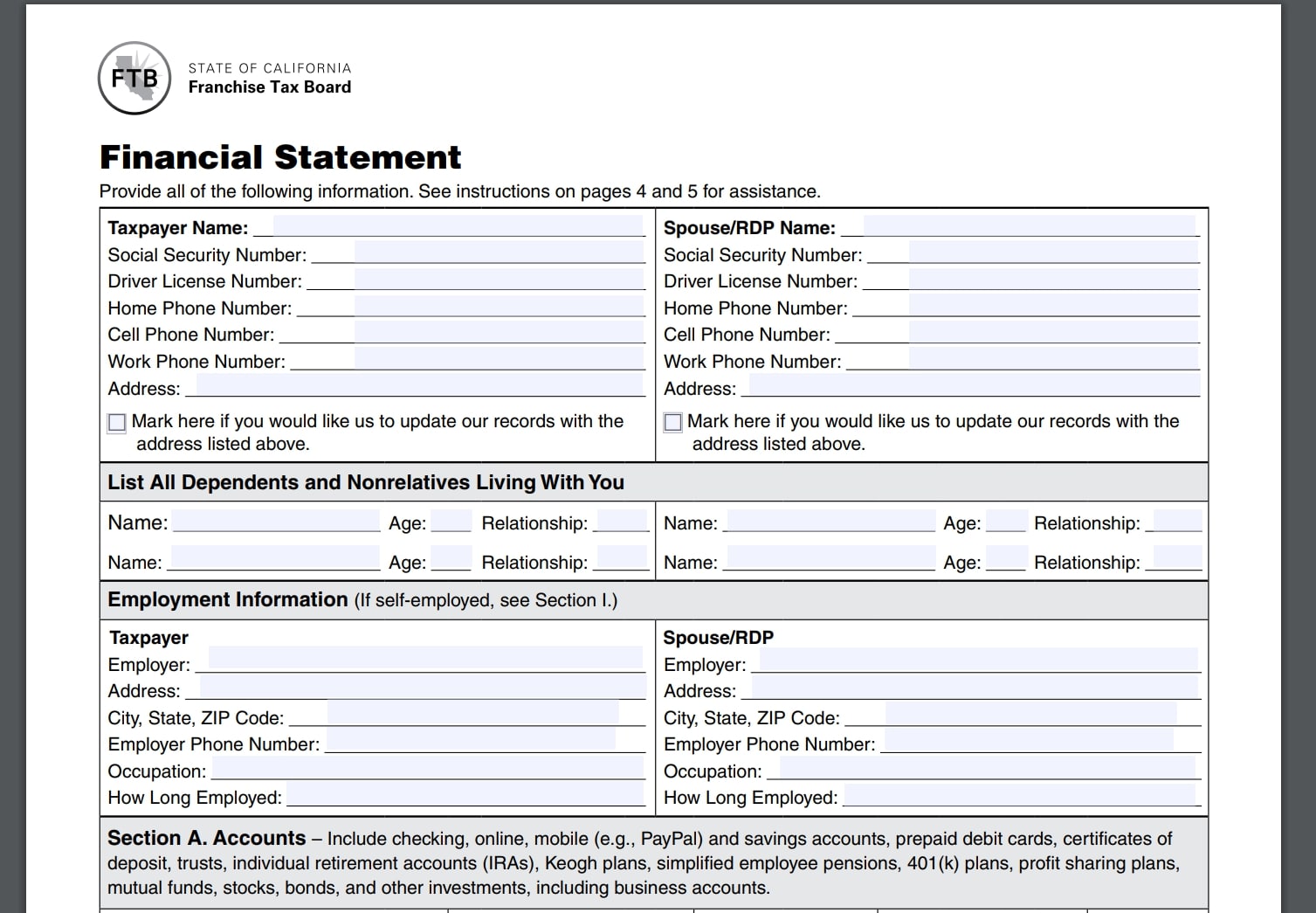

It will be added to your credit report once the judgment has been filed. It is crucial to keep this information up to date in order to ensure your credit report is current. You can request to pay the judgment in installments if you are unable to pay the full amount. You will need to complete the Request to pay Judgment form along with a financial statement. After completing these steps, you will need to file the forms with court. The filing of these forms is easy and does not involve any fees.

Contacting a credit card company

You have the right to defend against a creditor who sues your credit card company for credit card debt. In some instances, you can try to settle out of court. In some cases, you may be able to settle out of court. However, in others, it is better to contact a credit union before a judgment has been entered. Refusing to respond to a lawsuit may lead you to larger problems down the line.

Make sure you follow the steps when contacting credit card companies. To verify your debt, you will need to first request one. This document reveals if the debt is yours or the creditor's. This letter should be sent certified to prove that it was received. If you suspect the account is fraudulent, you can challenge it.

Filing an answer to a lawsuit

It is essential to file an answer to a lawsuit if you have been sued for credit card debt. You can't fight the lawsuit if your answer isn't filed. Before a default judgment can be granted, the creditor must present proof of the debt. The court can suspend the judgment if you respond to the lawsuit.

It is simple to file an answer in a lawsuit to avoid a credit card debt judgment. However, you must act quickly. If you do not respond within the time limit, the plaintiff can garnish your wages or attach your bank account.

A credit card collection agency will offer a payment plan

Although it can be a good way to avoid being judged, a payment plan from credit card debt collection agencies is not without risk. If you do not make your payment, the credit card collection agency could threaten you with imprisonment. While this can be tempting, ignoring these threats can only make the situation worse.

It is important that you talk to your options before agreeing to a payment schedule with a credit-card collection agency. The agency may be willing and able to help you create a payment schedule that will allow for you to pay your debt off over time. To get a fair settlement, speak to the attorney from the credit card collection agency.

FAQ

How can a novice earn passive income as a contractor?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You may even have a few ideas already. If you do, great! If you do, great!

Online earning money is easy if you are looking for opportunities that match your interests and skills.

You can create websites or apps that you love, and generate revenue while sleeping.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. That way, you'll stick with it long-term.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

There are two main ways to go about this. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

Either way, once you have established your rates, it's time to market them. This can be done via social media, emailing, flyers, or posting them to your list.

These three tips can help increase your chances to succeed when you promote your company:

-

Be a professional in all aspects of marketing. You never know who could be reading and evaluating your content.

-

Know your subject matter before you speak. A fake expert is not a good idea.

-

Emailing everyone in your list is not spam. For a recommendation, email it to the person who asked.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Get feedback. Ask friends and relatives if they would be interested and receive honest feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

Keep learning - continue to grow as a marketer so you stay relevant.

What is personal finance?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You don't need to worry about monthly rent and utility bills.

Not only will it help you to get ahead, but also how to manage your money. It can make you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

So, who cares about personal financial matters? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today, people use their smartphones to track budgets, compare prices, and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. That leaves only two hours a day to do everything else that matters.

You'll be able take advantage of your time when you understand personal finance.

What is the difference between passive income and active income?

Passive income is when you earn money without doing any work. Active income requires hard work and effort.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. Examples include creating a website, selling products online and writing an ebook.

Passive income allows you to be more productive while making money. Most people don't want to work for themselves. Instead, they decide to focus their energy and time on passive income.

Problem is, passive income won't last forever. If you are not quick enough to start generating passive income you could run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, It is best to get started right away. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types or passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

What side hustles are the most profitable?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types side hustles: active and passive. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

The best side hustles make sense for you and fit well within your lifestyle. You might consider starting your own fitness business if you enjoy working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

Side hustles can be found anywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you are a skilled writer, why not open your own graphic design studio?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. When the opportunity presents itself, be prepared to jump in and seize it.

Remember, side hustles aren't just about making money. They can help you build wealth and create freedom.

With so many options to make money, there is no reason to stop starting one.

How much debt are you allowed to take on?

It is important to remember that too much money can be dangerous. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. If you are running out of funds, cut back on your spending.

But how much is too much? There is no universal number. However, the rule of thumb is that you should live within 10%. That way, you won't go broke even after years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. You should not spend more than $2,000 a month if you have $20,000 in annual income. Spend no more than $5,000 a month if you have $50,000.

It is important to get rid of debts as soon as possible. This includes credit card bills, student loans, car payments, etc. Once these are paid off, you'll still have some money left to save.

It is best to consider whether or not you wish to invest any excess income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. It would add up towards $500 over five-years. Over six years, that would amount to $1,000. In eight years, you'd have nearly $3,000 in the bank. You'd have close to $13,000 saved by the time you hit ten years.

In fifteen years you will have $40,000 saved in your savings. This is quite remarkable. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 you would now have $57,000.

It's crucial to learn how you can manage your finances effectively. Otherwise, you might wind up with far more money than you planned.

Is there a way to make quick money with a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. This means that you need to build a reputation both online and offline.

The best way to build a reputation is to help others solve problems. It is important to consider how you can help the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. One involves selling products directly to customers and the other is offering consulting services.

There are pros and cons to each approach. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. These gigs are also highly competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. It takes more time to become an expert in your field.

You must learn to identify the right clients in order to be successful at each option. This can take some trial and error. But it will pay off big in the long term.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

Get passive income ideas to increase cash flow

It is possible to make money online with no hard work. Instead, there are ways for you to make passive income from home.

Perhaps you have an existing business which could benefit from automation. Automation can be a great way to save time and increase productivity if you're thinking of starting a new business.

The more automated your company becomes, the more efficient you will see it become. This will allow you to focus more on your business and less on running it.

Outsourcing tasks is a great method to automate them. Outsourcing allows for you to focus your efforts on what really matters when running your business. Outsourcing a task is effectively delegating it.

You can concentrate on the most important aspects of your business and let someone else handle the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

A side hustle is another option. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

Articles are an example of this. There are many places where you can post your articles. These websites pay per article, allowing you to earn extra monthly cash.

You can also consider creating videos. Many platforms let you upload videos directly to YouTube and Vimeo. Posting these videos will increase traffic to your social media pages and website.

Stocks and shares are another way to make some money. Investing stocks and shares is similar investment to real estate. You are instead paid rent. Instead, you receive dividends.

You receive shares as part of your dividend, when you buy shares. The amount of dividend you receive depends on the stock you have.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. You will keep receiving dividends for as long as you live.