There are many options to consolidate medical bills. These options include unsecured personal loans, in-house financing, debt negotiation, and bankruptcy. You can learn more about each option and choose the one that best suits your needs. To avoid future medical expenses, you should first create a savings account. This will avoid you adding to your current debt.

Consolidating medical bills can be done with in-house financing

You can consolidate your medical bills by taking out a personal loan. In order to make your payments affordable, your providers can help you enroll in a debt reduction program. Many hospitals and physicians will work with patients who are experiencing financial difficulties. To work out a payment schedule with your providers, it is important that you contact them as soon as possible. You may end up paying more if you wait too long.

Consolidating medical debt is a great option for people with medical debt. However, it's not for everyone. It can help you reduce monthly payments and save money but could ultimately end up hurting credit. You should also consider other options before you make this decision.

Unsecured personal loan

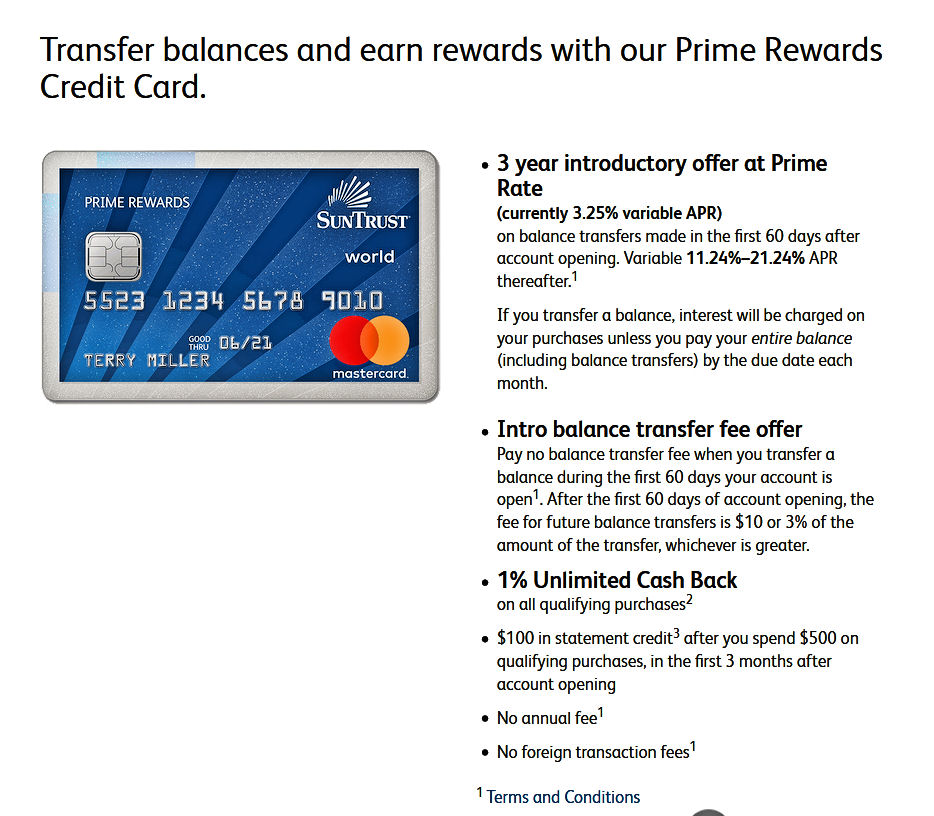

You may be able to get an unsecured personal loan to help pay off debt if you are facing financial difficulties because of medical bills. These loans can be obtained through banks, credit unions and online lenders. The interest rates and repayment terms for these loans vary, with some ranging from 2 to 10 years. Consider this type of loan if you are looking for the lowest interest rate.

To pay off medical bills, another option is to get a secured loan. These loans generally have lower interest rates compared to unsecured loans. However you must make sure that you can repay the money in a given time. Also, be aware that an unsecured loan can lead to a default on your credit report, which can harm your credit score.

Debt negotiation

A debt negotiation to consolidate medical bills might be an option for you if you are experiencing financial difficulties. Although it's not an easy task, a competent debt negotiator may be able to help you obtain a lower interest and monthly payments as well as debt elimination. You may also be eligible for debt consolidation loans. This will combine all of your existing debts into a single loan that you can pay back over time.

Negotiating with your creditors is part and parcel of debt negotiation for medical bill consolidation. Certain qualifications are required. You must first be able show financial hardship. You must also be able and willing to transfer a portion of your bills into an escrow bank. You might be out of luck if this money is not available.

Bankruptcy

Medical bill consolidation is a way to pay off medical debt without filing for bankruptcy. This service is available to clients through banks, credit unions and online lenders. The medical bill consolidation loan is an unsecure personal loan. Lenders cannot use your home as collateral. Consumers often prefer this option, as they may not be financially able to repay the entire amount without a loan.

The Chapter 7 bankruptcy and Chapter 13 forms for medical bill consolidation bankruptcy are both available. The former lets you combine your medical bills with other unsecured debt into one single payment. In either case the bankruptcy court will establish a repayment program based on your income and expenses. Special relief is available for senior citizens, veterans, and those in recovery.

Non-profit credit counseling

Consolidating debt through medical bill consolidation is an effective way to reduce your debt. This type of consolidation can help reduce your interest payments on your credit cards. A non-profit credit counseling agency will help you establish a debt management plan which will allow for you to combine your credit card and medical debt.

Although these counseling services are usually free, some may charge a small fee. Before signing up for a program, you should know the details. If the service isn't free, you should read about the costs and whether or not it will work for your needs.

FAQ

How can rich people earn passive income?

There are two options for making money online. Another way is to make great products (or service) that people love. This is known as "earning" money.

A second option is to find a way of providing value to others without creating products. This is what we call "passive" or passive income.

Let's imagine you own an App Company. Your job is developing apps. Instead of selling apps directly to users you decide to give them away free. It's a great model, as it doesn't depend on users paying. Instead, you rely upon advertising revenue.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how most successful internet entrepreneurs earn money today. They focus on providing value to others, rather than making stuff.

How do you build passive income streams?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

This means that you must understand their wants and needs. It is important to learn how to communicate with people and to sell to them.

The next step is to learn how to convert leads in to sales. You must also master customer service to retain satisfied clients.

This is something you may not realize, but every product or service needs a buyer. You can even design your entire business around that buyer if you know what they are.

To become a millionaire it takes a lot. A billionaire requires even more work. Why? You must first become a thousandaire in order to be a millionaire.

Then you must become a millionaire. You can also become a billionaire. It is the same for becoming a billionaire.

So how does someone become a billionaire? You must first be a millionaire. You only need to begin making money in order to reach this goal.

But before you can begin earning money, you have to get started. Let's discuss how to get started.

Which side hustles have the highest potential to be profitable?

Side hustles are income streams that add to your primary source of income.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types: active and passive side hustles. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that make sense and work well with your lifestyle are the best. Start a fitness company if you are passionate about working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles can be found anywhere. Side hustles can be found anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? You might also have writing skills, so why not start your own ghostwriting business?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles don't have to be about making money. Side hustles can be about creating wealth or freedom.

And with so many ways to earn money today, there's no excuse to start one!

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You no longer have to worry about paying rent or utilities every month.

Not only will it help you to get ahead, but also how to manage your money. It makes you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

So who cares about personal finance? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

People now use smartphones to track their money, compare prices and create wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. This leaves just two hours per day for all other important activities.

When you master personal finance, you'll be able to take advantage of that time.

How can a novice earn passive income as a contractor?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You may even have a few ideas already. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

You can make money online by looking for opportunities that match you skills and interests.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what you choose to concentrate on, it is important that you pick something you love. This will ensure that you stick with it for the long-term.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

There are two main ways to go about this. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In either case, once you've set your rates, you'll need to promote them. You can share them on social media, email your list, post flyers, and so forth.

These are three ways to improve your chances of success in marketing your business.

-

When marketing, be a professional. You never know who could be reading and evaluating your content.

-

Be knowledgeable about the topic you are discussing. False experts are unattractive.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. For a recommendation, email it to the person who asked.

-

Make sure you have a reliable email provider. Yahoo Mail and Gmail are both free and easy-to-use.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Measure your ROI - measure the number of leads generated by each campaign, and see which campaigns bring in the most conversions.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Test different tactics - try multiple strategies to see which ones work better.

-

You must continue learning and remain relevant in marketing.

How much debt is considered excessive?

It's essential to keep in mind that there is such a thing as too much money. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. When you run out of money, reduce your spending.

But how much do you consider too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. That way, you won't go broke even after years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 And if you make $50,000, you shouldn't spend more than $5,000 per month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans, credit cards, car payments, and student loans. You'll be able to save more money once these are paid off.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. You can still expect interest to accrue if your money is saved.

Consider, for example: $100 per week is a savings goal. It would add up towards $500 over five-years. Over six years, that would amount to $1,000. You would have $3,000 in your bank account within eight years. It would take you close to $13,000 to save by the time that you reach ten.

In fifteen years you will have $40,000 saved in your savings. It's impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 you would now have $57,000.

That's why it's important to learn how to manage your finances wisely. If you don't, you could end up with much more money that you had planned.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

How to make money online without any experience

There are many different ways to make money online. While some people like to use computers for work, others prefer to be outside and interact with others.

However, regardless of what kind of person you are, there is always room for improvement. We will be looking at simple ways you can improve your life.

Blogging has grown exponentially since its early beginnings. Anyone can set up a blog from any computer and make money.

A blog is not only free, but it's very easy to set up too. A domain name and hosting services are all you will need if you don't have any knowledge about blogging.

Selling photos online has become one of today's most popular ways to make money. It doesn't really matter if you are a good photographer or not.

A good digital camera is all that's required. Once you have all the necessary tools, you can upload your images onto Fotolia to get high-quality photos that you can download.

Sell your skills if they are relevant to you. Whether you're great at writing articles or speak several languages fluently, there are plenty of places online where you can sell your expertise.

Elance is a site that connects freelancers and businesses looking to hire them. Projects are posted by people who need assistance and freelancers compete for them. The project gets completed by the highest-bidder.

-

Create an Ebook and Sell it On Amazon

Amazon is the most popular e-commerce site on the Internet. They offer a marketplace where people can buy and sell items.

This allows you to create an ebook and make it available through Amazon. This is a great choice because you get paid per sales and not per page.

Teaching abroad can be a great way to earn extra income without ever leaving your country. Teachers Pay Teachers is a site that connects teachers and students looking for English lessons.

Teaching can be done in any subject: math, science or geography.

-

Google Write Adsense Articles is For Other free Website advertising Another system popular offered way by google. When someone visits your website, you place small advertisements throughout the pages of the website. These ads appear on any webpage that is viewed by visitors.

The more traffic you have, the more you will make.

Digitally selling artwork is also possible. You can also sell your artwork digitally through sites such as Etsy.

Etsy lets users create virtual shops that look and act like real stores.

Students are becoming more interested in freelance work. As the economy continues to improve, more companies are outsourcing jobs to independent contractors.

Both employees and employers win. Employers save money since they no longer have to pay benefits or payroll taxes. Employees gain flexibility in their schedules and an increase in income.