A legitimate payday loan consolidation firm is a good option if you're looking to consolidate your debt. These companies offer many helpful services and specialize in combining payday loan. We'll be discussing the requirements to consolidate payday loans and what you should look for in a legitimate business.

Applying for a Payday Loan

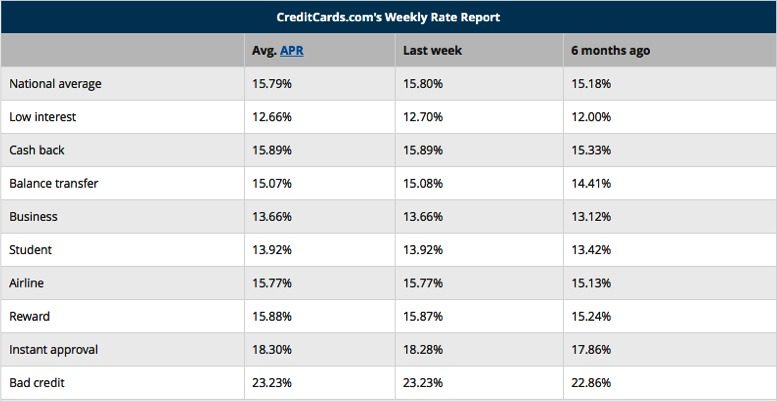

You need to have a minimum loan balance of at least $1,000 to be eligible for a consolidation loan with a payday lender. You can apply online, or at a local bank. Compare rates to avoid overpaying. Most lenders will offer a prequalification process, which does not impact your credit rating. Once you've been approved, make sure to pay off the loan within the agreed time. You could be charged late fees or even reported to the credit bureau if you miss a payment.

Payday loan consolidation programs work by working with a company that represents the borrower to lenders. This company can also be known as a debt settlement firm or a management company. The company will work with your to negotiate lower fees. The fees are usually less than a payday advance, and the loan will be repaid over a greater time period.

Consolidating a payday advance loan costs

A consolidation loan is a great option for borrowers who wish to consolidate multiple payday loans into one monthly payment. It makes life easier by eliminating the need to pay high interest rates on several installments each month. Instead of making multiple payments each month, borrowers pay one monthly amount to a single company. This company pays all their payday lenders on their behalf. Additionally, payday loan consolidation companies do not report debts directly to credit bureaus. The debt will not appear on the debtor’s credit score.

Borrowers who are stuck in a cycle or have difficulty paying their bills can consolidate their payday loan debt. Payday loans come with high interest rates, short repayment terms, and many borrowers end in rolling over their existing debt to get new loans. However, there are also other options, such as rollovers, debt management plans (DMPs), and Chapter 7 bankruptcy. You should do the math before taking out a consolidation loan for payday loans.

Legality of consolidation loans

By consolidating loans, payday loan consolidation companies reduce the amount owed. This is advantageous as it allows borrowers to make only one monthly payment, rather than many. Overdraft fees can be a problem and debt collection agencies may contact borrowers to request additional payments. These actions can lead to lawsuits in some cases.

The process of payday loan consolidation is similar to other debt consolidation services. The lender will negotiate with lenders to lower the balances. The lender will examine your interest rates and negotiate for a lower monthly repayment. If you are eligible, the consolidation company will offer a loan consolidation that will pay off all your debts automatically. If not, you will have the funds transferred to your account and you will have debt repayments.

The signs of a legitimate company

First, make sure to verify that the company actually has a physical address. Legitimate businesses will include a business address in their website or Google map. If the address is not listed, it is likely a fraud. The failure to respond to complaints or reviews is another sign that the scammer is not serious. Be aware that there are numerous scams in the industry of debt consolidation. Using the guidelines above will help you avoid falling victim to these predatory companies.

A legitimate payday loan consolidation business does not require you to pay any upfront fees. A fake company will charge you upfront. A legit business will follow all guidelines laid out by the FTC. If you are offered a quote on the phone or on email without mentioning the fees, don't waste your time.

FAQ

Which passive income is easiest?

There are many options for making money online. However, most of these require more effort and time than you might think. So how do you create an easy way for yourself to earn extra cash?

Finding something you love is the key to success, be it writing, selling, marketing or designing. and monetize that passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is known as affiliate marketing and you can find many resources to help get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You might also think about starting a blog to earn passive income. Once again, you'll need to find a topic you enjoy teaching about. After you've created your website, you can start offering ebooks and courses to make money.

While there are many methods to make money online there are some that are more effective than others. You can make money online by building websites and blogs that offer useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is called content marketing, and it's a great method to drive traffic to your website.

What's the best way to make fast money from a side-hustle?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

You need to be able to make yourself an authority in any niche you choose. This means that you need to build a reputation both online and offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. You need to think about how you can add value to your community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many ways to make money online.

However, if you look closely you'll see two major side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its advantages and disadvantages. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. You will also find fierce competition for these gigs.

Consulting is a great way to expand your business, without worrying about shipping or providing services. It takes more time to become an expert in your field.

To be successful in either field, you must know how to identify the right customers. This takes some trial and errors. But, in the end, it pays big.

Why is personal financing important?

Anyone who is serious about financial success must be able to manage their finances. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why should we save money when there are better things? Is there nothing better to spend our time and energy on?

Yes and no. Yes, most people feel guilty saving money. Yes, but the more you make, the more you can invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

It is important to learn how to control your emotions if you want to become financially successful. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This could be because you don't know how your finances should be managed.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will save you money and help you pay for your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

Which side hustles are most lucrative?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles provide extra income for fun activities and bills.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types: active and passive side hustles. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. You can also do side hustles like tutoring and dog walking.

The best side hustles make sense for you and fit well within your lifestyle. Start a fitness company if you are passionate about working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

Side hustles can be found anywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

You might open your own design studio if you are skilled in graphic design. Perhaps you're an experienced writer so why not go ghostwriting?

You should do extensive research and planning before you begin any side hustle. If the opportunity arises, this will allow you to be prepared to seize it.

Side hustles are not just about making money. They are about creating wealth, and freedom.

And with so many ways to earn money today, there's no excuse to start one!

How do rich people make passive income?

If you're trying to create money online, there are two ways to go about it. Another way is to make great products (or service) that people love. This is called "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is called "passive" income.

Let's say you own an app company. Your job is development apps. You decide to give away the apps instead of making them available to users. It's a great model, as it doesn't depend on users paying. Instead, you can rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how internet entrepreneurs who are successful today make their money. Instead of making money, they are focused on providing value to others.

What is the distinction between passive income, and active income.

Passive income is when you make money without having to do any work. Active income requires hard work and effort.

If you are able to create value for somebody else, then that's called active income. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people aren’t keen to work for themselves. Instead, they decide to focus their energy and time on passive income.

Passive income doesn't last forever, which is the problem. You might run out of money if you don't generate passive income in the right time.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. You should start immediately. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are 3 types of passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How passive income can improve cash flow

There are many online ways to make extra money without any hard work. Instead, you can make passive income at home.

There may be an existing business that could use automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

Automating your business is a great way to increase its efficiency. This allows you to spend more time growing your business than managing it.

A great way to automate tasks is to outsource them. Outsourcing allows you and your company to concentrate on what is most important. When you outsource a task, it is effectively delegating the responsibility to another person.

This allows you to concentrate on the core aspects of your company while leaving the details to someone else. Outsourcing makes it easier to grow your business because you won't have to worry about taking care of the small stuff.

You can also turn your hobby into an income stream by starting a side business. A side hustle is another option to generate additional income.

If you like writing, why not create articles? You can publish articles on many sites. These websites allow you to make additional monthly cash by paying per article.

You can also consider creating videos. Many platforms enable you to upload videos directly onto YouTube or Vimeo. These videos can drive traffic to your website or social media pages.

Investing in stocks and shares is another way to make money. Investing in shares and stocks is similar to investing real estate. Instead of receiving rent, dividends are earned.

As part of your payout, shares you have purchased are given to shareholders. The amount of the dividend depends on how much stock you buy.

You can reinvest your profits in buying more shares if you decide to sell your shares. You will keep receiving dividends for as long as you live.