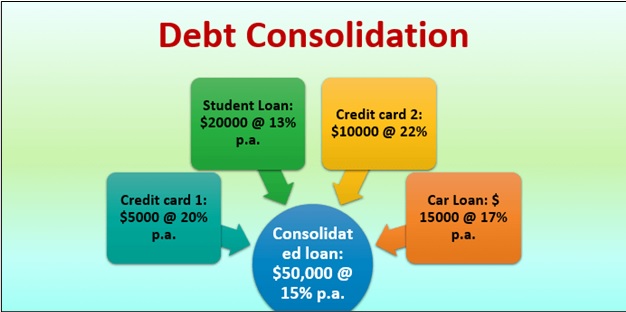

Debt consolidation is a service that enables people with large credit card balances to pay off their debts at a single lower monthly payment. Non-profit debt consolidators automatically deduct the monthly payment from your account, rather than sending you individual checks. The monthly payment is then split among your creditors.

InCharge Debt Solutions

InCharge Debt Solutions provides a free consultation by phone or online. This consultation will give potential clients the chance to learn more about the debt management program. After the free consultation, you don't have to commit to signing up for the program. It also offers calculators and educational materials. The company offers a debt management program that can help you resolve up to $10,000 of debt.

InCharge Debt Solutions offers credit counseling. The consultation takes around 30 minutes and the counseling session is free. The company's debt management program costs $33 per month plus a $75 set-up fee. The cost of the plan is very affordable compared with other debt management plans.

The Better Business Bureau has rated the company as A+. Its services are also accredited through the Council on Accreditation of Consumer Credit Counseling. It is a member and a trusted nonprofit of the National Foundation for Credit Counseling. Trustpilot also rates it A+.

InCharge Credit Counseling

InCharge offers credit counselling, debt management and financial education. InCharge counselors work with credit card companies in order to lower your interest rates, and lower your monthly payments. They also assist in eliminating late fees, over limit charges and other fees. Through their debt management programs, clients can eliminate all of their debt in three years or less.

InCharge Debt Solutions provides free credit counseling and offers debt management plans that can be paid for. There is a $75 setup fee for the credit counseling services, but these fees are low in comparison to industry standards. You will be stopped by debt collectors from calling. They also offer a complimentary consultation.

Nonprofit credit counseling is a great option if you're looking for a way to manage your debts and lower your interest rates. These services are completely free of judgement. The counselor will help you create a budget and select the right program for your situation. For those who have bad credit or need help with debt reduction, nonprofit credit counseling is a great option.

Optimum Credit Consulting

Consumers with a lot of unsecure debt can get financial help from non-profit debt consolidation companies. These types of debt include credit cards such as department store cards, personal loans and lines of credit. Consolidating debts can lower monthly bills and help consumers qualify for better repayment terms.

Many non-profit organizations offer financial resources like budgeting worksheets, personal financial workbooks, and debt calculators for their clients. These calculators can be used to help consumers estimate how long they will need to pay off their debt. Many nonprofit organizations are also approved by the government to offer bankruptcy counseling.

Additionally, debt consolidation nonprofits do not require clients pay monthly fees for multiple credit cards. They consolidate debt, negotiate with creditors to reduce interest rates or other fees, and offer debt consolidation programs. Some nonprofit companies even waive their fees if clients are experiencing severe financial hardship.

FAQ

How can rich people earn passive income?

There are two main ways to make money online. Another way is to make great products (or service) that people love. This is known as "earning" money.

A second option is to find a way of providing value to others without creating products. This is "passive" income.

Let's say that you own an app business. Your job involves developing apps. Instead of selling apps directly to users you decide to give them away free. Because you don't rely on paying customers, this is a great business model. Instead, you rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how internet entrepreneurs who are successful today make their money. Instead of making money, they are focused on providing value to others.

How much debt is too much?

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much is too much? There is no universal number. However, the rule of thumb is that you should live within 10%. That way, you won't go broke even after years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It is important to get rid of debts as soon as possible. This includes student loans, credit card debts, car payments, and credit card bill. When these are paid off you'll have money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. You could lose your money if you invest in stocks or bonds. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. That would amount to $500 over five years. In six years you'd have $1000 saved. In eight years, your savings would be close to $3,000 In ten years you would have $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. This is quite remarkable. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 in savings, you would have more than 57,000.

This is why it is so important to understand how to properly manage your finances. A poor financial management system can lead to you spending more than you intended.

How can a beginner earn passive income?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You may have some ideas. If you do, great! However, if not, think about what you can do to add value to the world and how you can put those thoughts into action.

Online earning money is easy if you are looking for opportunities that match your interests and skills.

There are many ways to make money while you sleep, such as by creating websites and apps.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. That way, you'll stick with it long-term.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

You have two options. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

In either case, once you've set your rates, you'll need to promote them. This includes sharing your rates on social media and emailing your subscribers, as well as posting flyers and other promotional materials.

These three tips can help increase your chances to succeed when you promote your company:

-

You are a professional. When you work in marketing, act like one. You never know who may be reading your content.

-

Know what you are talking about. Before you start to talk about your topic, make sure that you have a thorough understanding of the subject. False experts are unattractive.

-

Emailing everyone in your list is not spam. For a recommendation, email it to the person who asked.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results. You can track who opens your messages, clicks links, or signs up for your mail lists.

-

How to measure ROI: Measure the number and conversions generated by each campaign.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

Learn new things - Keep learning to be a marketer.

What is the difference between passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income is earned through hard work and effort.

If you are able to create value for somebody else, then that's called active income. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income allows you to be more productive while making money. Most people aren’t keen to work for themselves. So they choose to invest time and energy into earning passive income.

Problem is, passive income won't last forever. If you hold off too long in generating passive income, you may run out of cash.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. It's better to get started now than later. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types of passive income streams:

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Why is personal financial planning important?

For anyone to be successful in life, financial management is essential. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why should we wait to save money? Is there nothing better to spend our time and energy on?

Yes and no. Yes because most people feel guilty about saving money. No, because the more money you earn, the more opportunities you have to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

To become financially successful, you need to learn to control your emotions. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This could be because you don't know how your finances should be managed.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will save you money and help you pay for your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the easiest passive income?

There are many different ways to make online money. Some of these take more time and effort that you might realize. How can you make it easy for yourself to make extra money?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. When readers click on those links, sign them up to your email list or follow you on social networks.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

As another source of passive income, you might also consider starting your own blog. Again, you will need to find a topic which you love teaching. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many methods to make money online there are some that are more effective than others. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is content marketing. It's an excellent way to bring traffic back to your website.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How To Make Money Online

How to make money online today differs greatly from how people made money 10 years ago. The way you invest your money is also changing. Although there are many options for passive income, not all require large upfront investments. Some methods are simpler than others. But if you want to make real money online, there are some things you should consider before investing your hard-earned cash into anything.

-

Find out which type of investor you are. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. Research is essential before you make any commitment to any program. Check out past performance records and testimonials before you commit to any program. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not just jump in to one huge project. Start small and build something first. This will help to you get started and allow you to decide if this type business is right for your needs. Once you feel confident enough to take on larger projects.

-

Get started now! It's never too soon to start making online money. Even if a long-term employee, there's still time to build up a profitable portfolio of niche websites. All you need are a great idea and some dedication. You can take action right now by implementing your ideas.