This article will explain what a charge-off is in accounting and how it affects your credit report. A chargeoff is a negative note that has been added to a loan. A charge-off will remain on your credit report and be there for seven years. This can make it more difficult for you to get credit. This negative mark can have a direct impact on your credit score. Collection agencies report a charge-off if you don't make your payments.

Charge-off

A charge-off can have serious consequences for your credit score. You could find yourself in this situation if the amount you owe is higher than your ability to pay it or if you don't make enough payments. There are some things that you can do to help improve your credit score. You must first determine what has happened to your account.

You will receive a charge-off notice if you are 90 to 180 day late with your payments. A chargeoff is not the equivalent of a collection. A collection agency can contact you to collect the amount owed. The collection agency will continue to pursue the debt until it is fully paid or you have paid it off. If you don’t pay the account in full, the collection agent can sue for a judgment.

Charge-off debt

A charge off is a writeoff of a debt. It happens when a creditor decides to cancel a debt and does not pursue collection efforts. It is a common practice in today's economy. It's cheaper than this type of write off.

It is important that you remember that debt charges can have a negative impact on your credit score. It is therefore crucial to pay the debt off as soon as possible.

Accounting charges

A charge off is an accounting term that refers to a debt that has become uncollectible. Lenders may charge off a debt if it is more than four to six monthly late and the debtor has not been able to pay. This is an internal accounting function. It's done to make sure that the bank's financial statements reflect the accounting rules. However, this doesn't mean the debt is gone.

Charge-offs are when the business that originated the loan decides that the borrower can't be repaid. There are many reasons charge-offs may occur, including the deterioration in credit scores and prolonged periods of delinquency. Charge-offs are something businesses must consider and many companies have an expense account.

Credit Report Revocation

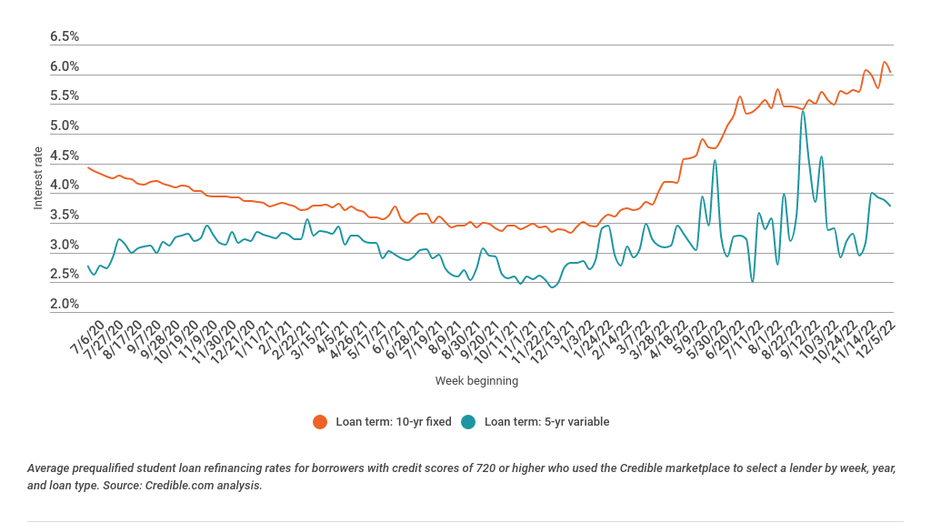

A charge-off on your credit report can have serious ramifications for your credit score. A charge-off can be listed on your credit file for up to seven consecutive years. A charge-off also can make it harder to qualify for credit or obtain competitive interest rates. You can improve your credit score without incurring a charge-off.

First, you should get an updated copy of your credit report. You can also dispute a charge-off with the credit agencies if you aren't satisfied. You can do this online or over-the-phone. But it is best to write a formal correspondence to the credit reporting agency. This will give you proof to support your claim. Within 30 days, the credit agencies will investigate the dispute.

Myths about charge-offs

If a borrower falls behind in payments, charge-offs may be the lender's last option. These are when a lender fails to settle a debt with the borrower and decides not to pursue it. The lender considers charge-offs a written-off debt, but the borrower is still responsible for the full payment.

Consumers who fail to pay the minimum monthly credit card bills for 180 days become liable for a charge-off. After this time, the lender closes the account and the consumer no longer receives interest. This misconception is often perpetuated by consumers who believe charge-offs signify that they owe no money.

FAQ

How can a beginner generate passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You may have some ideas. If you do, great! However, if not, think about what you can do to add value to the world and how you can put those thoughts into action.

The best way to earn money online is to look for an opportunity matching your skillset and interests.

You can create websites or apps that you love, and generate revenue while sleeping.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. It will be a long-lasting commitment.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

This can be done in two ways. You could charge a flat rate (like a freelancer), or per project (like an agencies).

You'll need promotion for your rates in either case. This includes sharing your rates on social media and emailing your subscribers, as well as posting flyers and other promotional materials.

These are three ways to improve your chances of success in marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. You never know who will review your content.

-

Know your subject matter before you speak. Fake experts are not appreciated.

-

Emailing everyone in your list is not spam. You can send a recommendation to someone who has asked for it.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

You can monitor your results by tracking how many people open your emails, click on links and sign up to your mailing lists.

-

Measure your ROI - measure the number of leads generated by each campaign, and see which campaigns bring in the most conversions.

-

Ask your family and friends for feedback.

-

Try different strategies - you may find that some work better than others.

-

Continue to learn - keep learning so that you remain relevant as a marketer.

How much debt is considered excessive?

It is vital to realize that you can never have too much money. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. You should cut back on spending if you feel you have run out of cash.

But how much can you afford? While there is no one right answer, the general rule of thumb is to live within 10% your income. That way, you won't go broke even after years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

It's important to pay off any debts as soon and as quickly as you can. This applies to student loans, credit card bills, and car payments. Once these are paid off, you'll still have some money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. You can still expect interest to accrue if your money is saved.

Let's take, for example, $100 per week that you have set aside to save. It would add up towards $500 over five-years. After six years, you would have $1,000 saved. You'd have almost $3,000 in savings by the end of eight years. By the time you reach ten years, you'd have nearly $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. That's pretty impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 you would now have $57,000.

This is why it is so important to understand how to properly manage your finances. A poor financial management system can lead to you spending more than you intended.

What side hustles are the most profitable?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles can also be a great way to save money for retirement, have more time flexibility, or increase your earning potential.

There are two types. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. You might consider starting your own fitness business if you enjoy working out. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles are available anywhere. Side hustles can be found anywhere.

You might open your own design studio if you are skilled in graphic design. Perhaps you're an experienced writer so why not go ghostwriting?

Be sure to research thoroughly before you start any side hustle. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles aren’t about making more money. They're about building wealth and creating freedom.

And with so many ways to earn money today, there's no excuse to start one!

How does a rich person make passive income?

There are two main ways to make money online. The first is to create great products or services that people love and will pay for. This is called "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is called "passive" income.

Let's suppose you have an app company. Your job involves developing apps. But instead of selling them directly to users, you decide to give them away for free. This business model is great because it does not depend on paying users. Instead, advertising revenue is your only source of income.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how the most successful internet entrepreneurs make money today. They focus on providing value to others, rather than making stuff.

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. If you do this well the money will follow.

While you might not know it, your contribution to the world has been there since day one. When you were a baby, you sucked your mommy's breast milk and she gave you life. When you learned how to walk, you gave yourself a better place to live.

If you keep giving value to others, you will continue making more. Actually, the more that you give, the greater the rewards.

Without even realizing it, value creation is a powerful force everyone uses every day. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

There are actually nearly 7 billion people living on Earth today. Each person creates an incredible amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. You would earn far more than you are currently earning working full-time.

Now let's pretend you wanted that to be doubled. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every day there are millions of opportunities for creating value. This includes selling ideas, products, or information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. The ultimate goal is to assist others in achieving theirs.

You can get ahead if you focus on creating value. You can get my free guide, "How to Create Value and Get Paid" here.

What is the difference in passive income and active income?

Passive income means that you can make money with little effort. Active income requires effort and hard work.

Active income is when you create value for someone else. When you earn money because you provide a service or product that someone wants. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great as it allows you more time to do important things while still making money. But most people aren't interested in working for themselves. Instead, they decide to focus their energy and time on passive income.

Passive income doesn't last forever, which is the problem. If you are not quick enough to start generating passive income you could run out.

Also, you could burn out if passive income is not generated in a timely manner. You should start immediately. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types to passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to Make Money From Home

There is always room for improvement, no matter what online income you have. Even the most successful entrepreneurs aren't able to grow their business and increase profits.

The problem is that starting a business can make it easy to become stuck in a rut. To focus solely on making money, rather than growing your company. You may spend more time on marketing rather than product development. Or you could neglect customer services altogether.

It is important to evaluate your progress periodically and ask yourself if you are improving or maintaining your status quo. These are five easy ways to increase income.

-

Increase your Productivity

Productivity isn’t about the output. To be productive, you must also be able accomplish your tasks. Find the parts of your job that take the most effort or energy and assign those tasks to someone else.

You could, for example, hire virtual assistants to manage your social media, email administration, and customer service.

You can also designate a team member who will create blog posts as well as another person who will manage your lead-generation campaigns. Choose people who can help you reach your goals faster and more effectively when delegating.

-

Marketing should be a secondary focus.

Marketing does not necessarily have to involve spending a lot of money. Some of the best marketers aren't paid employees at all. They are consultants who work for themselves and earn commissions based upon the value of their services.

Instead of advertising your products via print ads and radio, or TV, consider joining affiliate programs. These programs allow you to promote other businesses' products and services. For sales to occur, you don't have necessarily to buy high-end inventory.

-

Hire An Expert To Do What You Can't

To fill in the gaps, you can hire freelancers. A freelance designer could be hired to help you develop graphics for your site, if, for example, you don't know much about graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be a tedious task when you are a contractor. Invoicing is especially time-consuming when multiple clients want the same thing.

Apps like Xero or FreshBooks make it easy to invoice customers. It's easy to input all of your client details once you have the app and send them invoices.

-

Promote More Products with Affiliate Programs

Affiliate programs are great because they let you sell products without needing to stock inventory. Shipping costs are not an issue. You only need to create a link between your site and the vendor's website. Then, you receive a commission whenever someone buys something from the vendor. Affiliate programs not only help you make more money but they can also help you build your brand. If you can provide high-quality content and services, you will attract your audience.