Before you start using a consolidated loan calculator to consolidate all your debts, here are some important facts. First, it is important to know that consolidation is not quick. It involves analyzing your financial situation and consulting with a credit counselor. Additionally, your loan may be extended, which can lead to higher interest rates. However, if the loan's terms are favorable, this increase in interest payment can be offset.

Unsecured personal loan

A debt consolidation loan calculator allows you to estimate how much money is owed and how much you can pay each month. Enter the amounts of all your current debts as well as the interest rates. The calculator will calculate how long it will take for you to become debt-free.

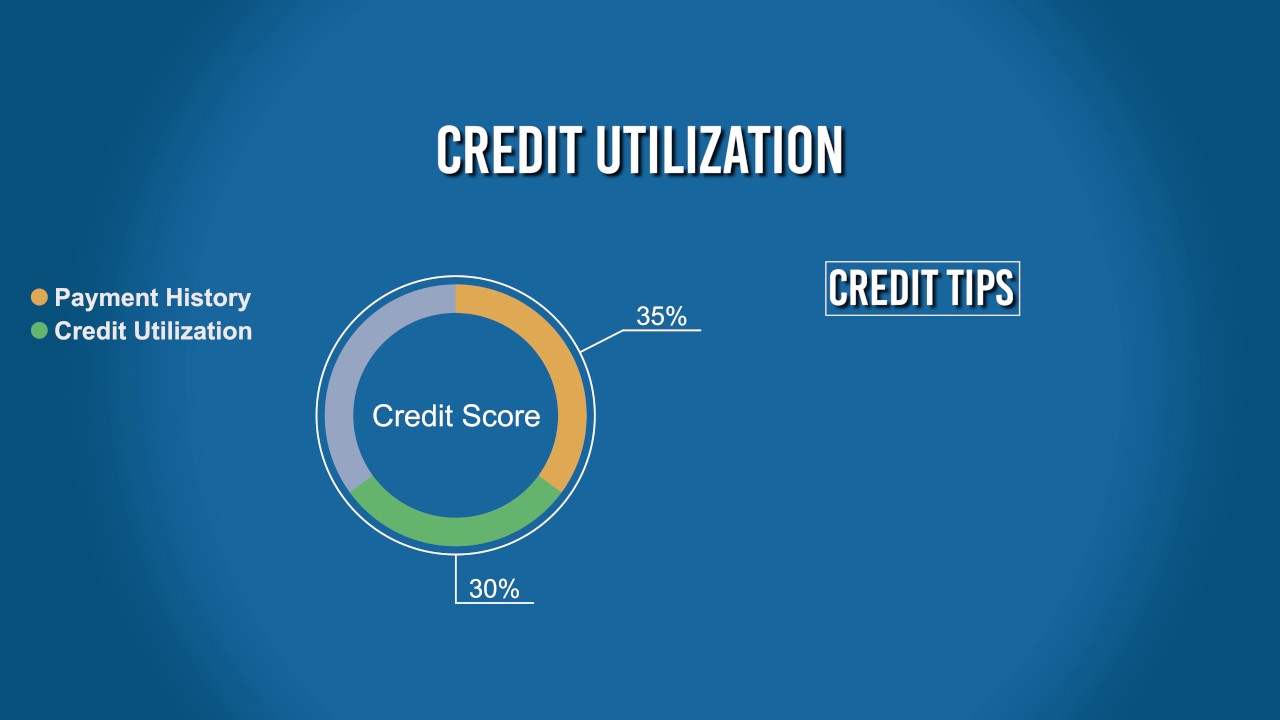

Your credit score and other factors will affect the APR of a consolidation loan. Higher credit scores may allow you to qualify for lower interest rates. In any case, you should shop around for the best interest rate. For example, if you have a score of 750, you could be eligible for an APR of just 6%. You could also be eligible for a higher APR if you have lower credit scores.

Home equity loans

If you have struggled with your payments on credit cards or other debts, you might consider consolidating them with a home equity loans. These loans are great for homeowners who want to rebuild their financial footing. They offer lower interest rates as well as longer repayment terms. This calculator will show you how your home equity can help you get the financial support and assistance you need.

Consider the amount you wish to borrow when using a home equity loan calculator. If you're looking to consolidate your debts, a $200,000 home Equity line of credit might be a good choice. Before you apply, make sure to consider the interest rate and loan term. You should remember that the higher your mortgage interest rate, the lower the interest rate for your home equity loan.

401k loan

A 401(k), loan allows you to borrow money out of your retirement account. You can borrow upto 50% of your vested account balance and pay it back over a time period. These loans are simpler than credit cards because they are fixed and automatically deducted directly from your paycheck. Before you borrow money from your retirement plan, however, there are some important rules.

First, you must determine your budget. Once you have set your budget, you can use a mortgage qualifier calculator to figure out how much money you can afford to borrow. These calculators consider your monthly income, total monthly payments, and the purchase price.

Consolidating student loans

Consolidation Loans are a type loan offered by the Federal Direct Student Loan Program. Consolidating all your student loans into one loan can be possible with these loans. They have a lower monthly payment and a longer repayment term. This type loan can be a great way of getting out of debt, and ensuring a brighter financial future.

The interest rate on a consolidated loan is based upon a weighted-average of all the loans that the borrower holds. This rate is fixed throughout the loan's term and generally lower than the interest rates for individual loans. However, if there are multiple interest rates on loans, your interest rate for the new loan could be higher than that of the older ones. This is why consolidating your loans should be considered.

FAQ

What's the difference between passive income vs active income?

Passive income means that you can make money with little effort. Active income requires hard work and effort.

You create value for another person and earn active income. Earn money by providing a service or product to someone. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people don't want to work for themselves. They choose to make passive income and invest their time and energy.

The problem is that passive income doesn't last forever. If you are not quick enough to start generating passive income you could run out.

You also run the risk of burning out if you spend too much time trying to generate passive income. It's better to get started now than later. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

What is personal finance?

Personal finance is about managing your own money to achieve your goals at home and work. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You won't have to worry about paying rent, utilities or other bills each month.

And learning how to manage your money doesn't just help you get ahead. It will make you happier. You will feel happier about your finances and be more satisfied with your life.

What does personal finance matter to you? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People use their smartphones today to manage their finances, compare prices and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. That leaves only two hours a day to do everything else that matters.

Financial management will allow you to make the most of your financial knowledge.

How do wealthy people earn passive income through investing?

If you're trying to create money online, there are two ways to go about it. Another way is to make great products (or service) that people love. This is known as "earning" money.

A second option is to find a way of providing value to others without creating products. This is called passive income.

Let's imagine you own an App Company. Your job involves developing apps. Instead of selling apps directly to users you decide to give them away free. That's a great business model because now you don't depend on paying users. Instead, you rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how successful internet entrepreneurs today make their money. They focus on providing value to others, rather than making stuff.

Why is personal finance important?

For anyone to be successful in life, financial management is essential. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why do we put off saving money? What is the best thing to do with our time and energy?

Yes and no. Yes because most people feel guilty about saving money. You can't, as the more money that you earn, you have more investment opportunities.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

Controlling your emotions is key to financial success. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because you aren't able to manage your finances effectively.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will save you money and help you pay for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What is the easiest passive income?

There are tons of ways to make money online. Most of them take more time and effort than what you might expect. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. and monetize that passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here are 101 affiliate marketing tips and resources.

Another option is to start a blog. Again, you will need to find a topic which you love teaching. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many online ways to make money, but the easiest are often the best. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is called content marketing, and it's a great method to drive traffic to your website.

What side hustles are the most profitable?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types of side hustles: passive and active. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. You can also do side hustles like tutoring and dog walking.

The best side hustles make sense for you and fit well within your lifestyle. If you love working out, consider starting a fitness business. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles can be found everywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

For example, if you have experience in graphic design, why not open your own graphic design studio? Or perhaps you have skills in writing, so why not become a ghostwriter?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. You'll be ready to grab the opportunity when it presents itself.

Side hustles can't be just about making a living. They can help you build wealth and create freedom.

And with so many ways to earn money today, there's no excuse to start one!

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to make money online

How to make money online today differs greatly from how people made money 10 years ago. The way you invest your money is also changing. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods are easier than others. But if you want to make real money online, there are some things you should consider before investing your hard-earned cash into anything.

-

Find out what type of investor are you. You might be attracted to PTC sites (Pay per Click), which pay you for clicking ads. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. You must research any program before you decide to commit. You should read reviews, testimonials, as well as past performance records. You don’t want to spend your time and energy on something that doesn’t work.

-

Start small. Do not just jump in to one huge project. Instead, start off by building something simple first. This will enable you to get the basics down and make a decision about whether or not this type of business is for your. Once you feel confident enough to take on larger projects.

-

Get started now! It is never too late to make money online. Even if a long-term employee, there's still time to build up a profitable portfolio of niche websites. All you need are a great idea and some dedication. So go ahead and take action today!