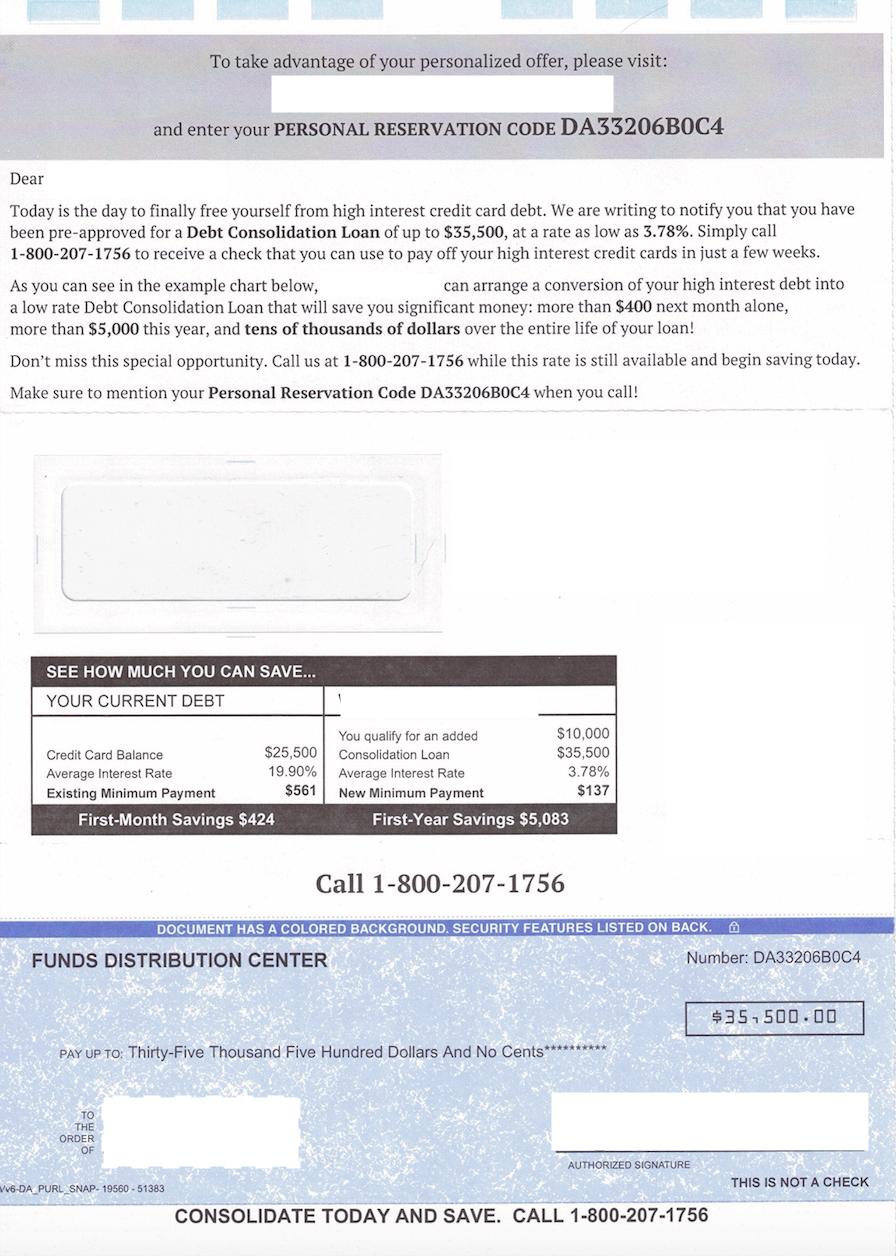

Consolidate debt calculator can be used to evaluate the pros and cons of various loan consolidation options. This tool allows you to compare the loan cost, frequency and payment amounts. The calculator shows the differences in costs on a bar graph. This calculator can help you choose the best loan consolidation option for you. But it is also useful to know about the less obvious downsides of debt consolidation.

Credit cards for balance transfer

A balance Transfer is a method of consolidating debt. It's a great option for people with poor credit who aren't able to get credit card offers. Depending on the number of debts to consolidate, the process can take two weeks or less. In some cases, late fees may not be applicable.

A balance transfer card credit card is an excellent choice for debt consolidation. The introductory APR is usually zero percent for a set period. Borrowers can save hundreds of dollars on interest by using these credit cards. Additionally, you can improve your credit score with a balance-transfer credit card.

401k Loans

A 401(k) loan is a great option for borrowers who are looking for a fast and easy way to consolidate their debt. The IRS allows you up to $50,000 to be borrowed for five years. The interest rate will be a little higher than the prime rate. You can typically expect to pay between 6% and 7% interest, depending on when you apply.

A 401(k), loan is also tax-free. You will not have to pay any taxes. You will also get the interest credited to your retirement account if you pay your bills on time. The lender will not report missed payments to credit bureaus if they are not made on time. This means you can easily catch-up if necessary. However, you should keep in mind that a 401(k) loan will cut into your retirement savings.

Home equity loans

A home equity loan can help you consolidate your debt and reduce your monthly payments. These loans often offer lower interest rates than comparable personal loans, and they may even be tax-deductible. You may not be eligible if your credit score is low. You should shop around for the best home equity loan deal for you. Each lender has its own minimum credit requirements.

Another drawback to home equity loans is that they require a home appraisal to determine the amount of equity you have in your home. This may cost you a few hundred dollars, depending on your location. In addition, you may be required to pay closing costs and other expenses.

Debt snowball method

Snowball is one way to consolidate your debt. This involves paying more on your smallest debt each monthly than you can afford. The extra money is then applied to the next smallest loan. This process is applicable to all types, including medical debt. The goal is to reduce your debt.

The snowball method is an excellent option for people who want to pay off their debts quickly and easily. Because you can start by paying only a small amount, it's an ideal way to motivate yourself to work hard.

Credit counseling

A debt calculator can help you estimate how much debt consolidation will cost you each month. You may be able lower your monthly debt consolidation payments. However, the amount you end-up paying over time will increase. Before making a decision about whether consolidation is right for your needs, you should consult a credit counselor.

This calculator allows you enter all of the information about your debt, including your credit card balances. You can also change the terms of your loan, interest rates, or other parameters. The results will help you see how much money will be saved and when you'll become debt-free.

FAQ

Which side hustles have the highest potential to be profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types: active and passive side hustles. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Side hustles that are active include tutoring, dog walking, and selling products on eBay.

Side hustles are smart and can fit into your life. A fitness business is a great option if you enjoy working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

Side hustles can be found anywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you are a skilled writer, why not open your own graphic design studio?

You should do extensive research and planning before you begin any side hustle. You'll be ready to grab the opportunity when it presents itself.

Remember, side hustles aren't just about making money. They're about building wealth and creating freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

How to build a passive income stream?

To make consistent earnings from one source you must first understand why people purchase what they do.

That means understanding their needs and wants. It is important to learn how to communicate with people and to sell to them.

Then you have to figure out how to convert leads into sales. Finally, you must master customer service so you can retain happy clients.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

A lot of work is required to become a millionaire. A billionaire requires even more work. Why? You must first become a thousandaire in order to be a millionaire.

And then you have to become a millionaire. Finally, you must become a billionaire. It is the same for becoming a billionaire.

How do you become a billionaire. Well, it starts with being a thousandaire. All you have do is earn money to get there.

You must first get started before you can make money. Let's discuss how to get started.

How does a rich person make passive income?

There are two ways you can make money online. One way is to produce great products (or services) for which people love and pay. This is called "earning" money.

Another way is to create value for others and not spend time creating products. This is what we call "passive" or passive income.

Let's say you own an app company. Your job is to create apps. But instead of selling the apps to users directly, you decide that they should be given away for free. Because you don't rely on paying customers, this is a great business model. Instead, you rely upon advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how successful internet entrepreneurs today make their money. Instead of making things, they focus on creating value for others.

Why is personal finance so important?

For anyone to be successful in life, financial management is essential. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why then do we keep putting off saving money. Is there something better to invest our time and effort on?

Yes, and no. Yes, most people feel guilty saving money. Because the more money you earn the greater the opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

Financial success requires you to manage your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This is because your financial management skills are not up to par.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

How much debt are you allowed to take on?

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. You should cut back on spending if you feel you have run out of cash.

But how much can you afford? There is no universal number. However, the rule of thumb is that you should live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You shouldn't spend more that $2,000 monthly if your income is $20,000 For $50,000 you can spend no more than $5,000 each month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes credit card bills, student loans, car payments, etc. When these are paid off you'll have money left to save.

It's best to think about whether you are going to invest any of the surplus income. You may lose your money if the stock markets fall. If you save your money, interest will compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. It would add up towards $500 over five-years. After six years, you would have $1,000 saved. You would have $3,000 in your bank account within eight years. You'd have close to $13,000 saved by the time you hit ten years.

After fifteen years, your savings account will have $40,000 left. It's impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000, you'd now have more than $57,000.

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

What is the easiest passive source of income?

There are many different ways to make online money. Some of these take more time and effort that you might realize. So how do you create an easy way for yourself to earn extra cash?

You need to find what you love. and monetize that passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here are some examples of 101 affiliate marketing tools, tips & resources.

A blog could be another way to make passive income. This time, you'll need a topic to teach about. You can also make your site monetizable by creating ebooks, courses and videos.

There are many online ways to make money, but the easiest are often the best. You can make money online by building websites and blogs that offer useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known content marketing.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means learning to do more than wait for someone to click on your link or buy your product. It is possible to make money while you are sleeping.

This requires you to create an automated system that makes money without you having to lift a finger. To do that, you must master the art of automation.

It would be a great help to become an expert in building software systems that automate tasks. You can then focus on making money, even while you're sleeping. You can even automate yourself out of a job.

This is the best way to identify these opportunities. Start by listing all of your daily problems. Consider automating them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. You now need to decide which one would be the most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Or if you are a graphic designer, perhaps you could create templates that can be used to automate the production of logos.

Perhaps you are a business owner and want to develop software that allows multiple clients to be managed at once. There are many possibilities.

Automating anything is possible as long as your creativity can solve a problem. Automation is the key to financial freedom.