It is difficult to define what a good balance between income and debt. It is dependent on your lifestyle, goals, income level and tolerance for financial risk. There are several ways to calculate the ratio and ensure it is close to what you want.

Calculating the right debt-to-income ratio

The key metric used to evaluate a borrower’s financial health is the debt-to-income ratio. Lenders will look at a variety of factors when determining the right debt-to-income ratio for an individual. These factors include income and job stability, as well as the amount of debt.

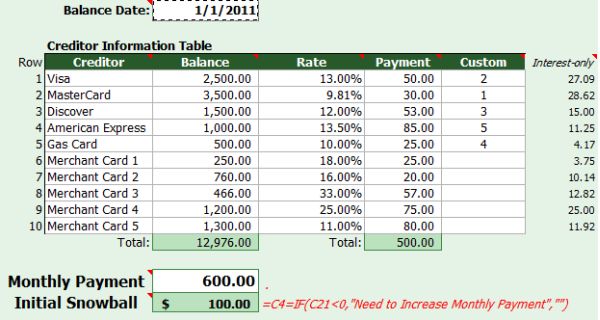

Lenders use this ratio to determine loan eligibility. It is calculated using the monthly debt payments divided by the gross income. Gross monthly income is the amount of money earned before taxes and deductions are made. Additionally, minimum payments like mortgage payments or recurring monthly charges are included in this calculation.

Add all of your monthly obligations to calculate the debt-to-income ratio. This includes minimum credit card payments and student loan payments. Add up your monthly debts, including mortgage payments, property taxes and homeowners insurance. The amount of debt on your credit report can be included.

Reducing your debt by lowering your debt-to-income ratio

The debt-to-income ratio (DTI), is an important consideration when you are considering getting a loan for debt repayment. The better your DTI, Aside from paying off credit card debt, you can also reduce your debt-to–income ratio by repaying loans.

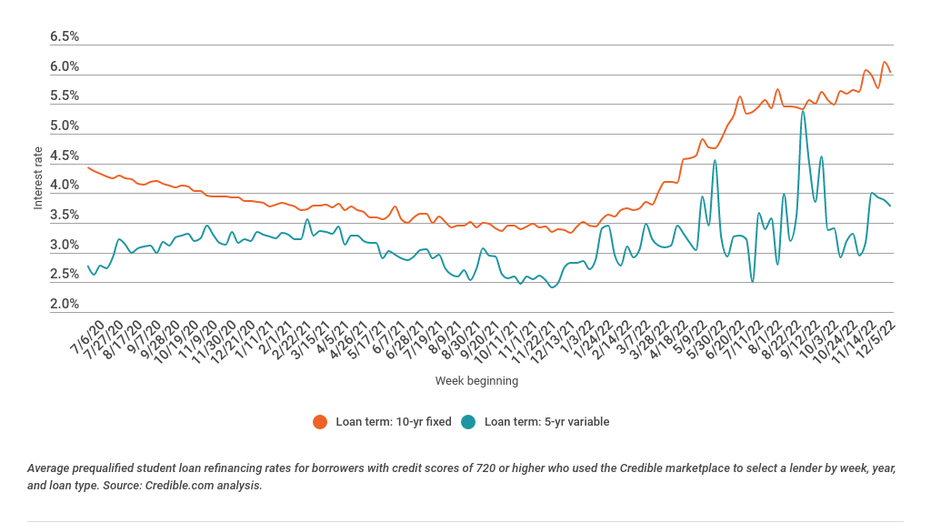

One way to lower your DTI is to lower the interest rates on your loans. This can be achieved by refinancing and negotiating with your creditors. The loan can be extended to reduce monthly payments. However, the interest rate may be higher. You could also be exposed to sudden income fluctuations. A side job is another option to increase income and lower your debt-to-income ratio.

Your income should not exceed 35%. It is a good idea to take drastic measures to reduce your personal debt-to–income ratio if it exceeds this level.

FAQ

What is the distinction between passive income, and active income.

Passive income is when you earn money without doing any work. Active income requires hardwork and effort.

Active income is when you create value for someone else. It is when someone buys a product or service you have created. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because you can focus on other important things while still earning money. Most people aren’t keen to work for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem is that passive income doesn't last forever. If you are not quick enough to start generating passive income you could run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, It is best to get started right away. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are 3 types of passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

How do wealthy people earn passive income through investing?

There are two main ways to make money online. One way is to produce great products (or services) for which people love and pay. This is called "earning" money.

A second option is to find a way of providing value to others without creating products. This is called "passive" income.

Let's imagine you own an App Company. Your job is development apps. You decide to give away the apps instead of making them available to users. It's a great model, as it doesn't depend on users paying. Instead, your advertising revenue will be your main source.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how the most successful internet entrepreneurs make money today. Instead of making things, they focus on creating value for others.

How much debt can you take on?

There is no such thing as too much cash. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. So when you find yourself running low on funds, make sure you cut back on spending.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. That way, you won't go broke even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000, you should' t spend more than $2,000 per month. Spend no more than $5,000 a month if you have $50,000.

Paying off your debts quickly is the key. This includes student loans and credit card bills. After these debts are paid, you will have more money to save.

It's best to think about whether you are going to invest any of the surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. You can still expect interest to accrue if your money is saved.

For example, let's say you set aside $100 weekly for savings. It would add up towards $500 over five-years. At the end of six years, you'd have $1,000 saved. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. This is quite remarkable. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, you'd now have more than $57,000.

You need to be able to manage your finances well. You might end up with more money than you expected.

Why is personal financing important?

A key skill to any success is personal financial management. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why do we put off saving money? Is there nothing better to spend our time and energy on?

Yes and no. Yes, most people feel guilty saving money. Because the more money you earn the greater the opportunities to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Financial success requires you to manage your emotions. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because you aren't able to manage your finances effectively.

These skills will prepare you for the next step: budgeting.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will save you money and help you pay for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What is the fastest way you can make money in a side job?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. It means building a name online and offline.

Helping others solve problems is the best way to establish a reputation. You need to think about how you can add value to your community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many opportunities to make money online. But they can be very competitive.

When you really look, you will notice two main side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its advantages and disadvantages. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs are also highly competitive.

Consulting allows you to grow your business without worrying about shipping products or providing services. But, it takes longer to become an expert in your chosen field.

To be successful in either field, you must know how to identify the right customers. It takes some trial and error. But it will pay off big in the long term.

What is the easiest passive income?

There are many different ways to make online money. But most of them require more time and effort than you might have. How do you find a way to earn more money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here are 101 affiliate marketing tips and resources.

As another source of passive income, you might also consider starting your own blog. This time, you'll need a topic to teach about. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

Although there are many ways to make money online you can choose the easiest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known as content marketing and it's a great way to drive traffic back to your site.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to Make Money Even While You Sleep

If you are going to succeed online, you must learn how to sleep while you are awake. This means more than waiting for someone to click on the link or buy your product. It is possible to make money while you are sleeping.

You must be able to build an automated system that can make money without you even having to move a finger. Automating is the key to success.

It would help if you became an expert at building software systems that perform tasks automatically. You can then focus on making money, even while you're sleeping. You can automate your job.

This is the best way to identify these opportunities. Start by listing all of your daily problems. Consider automating them.

Once you've done this, it's likely that you'll realize there are many passive income streams. Now, you have to figure out which would be most profitable.

A website builder, for instance, could be developed by a webmaster to automate the creation of websites. If you are a designer, you might be able create templates that automate the creation of logos.

If you have a business, you might be able to create software that allows you manage multiple clients simultaneously. There are many options.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is key to financial freedom.