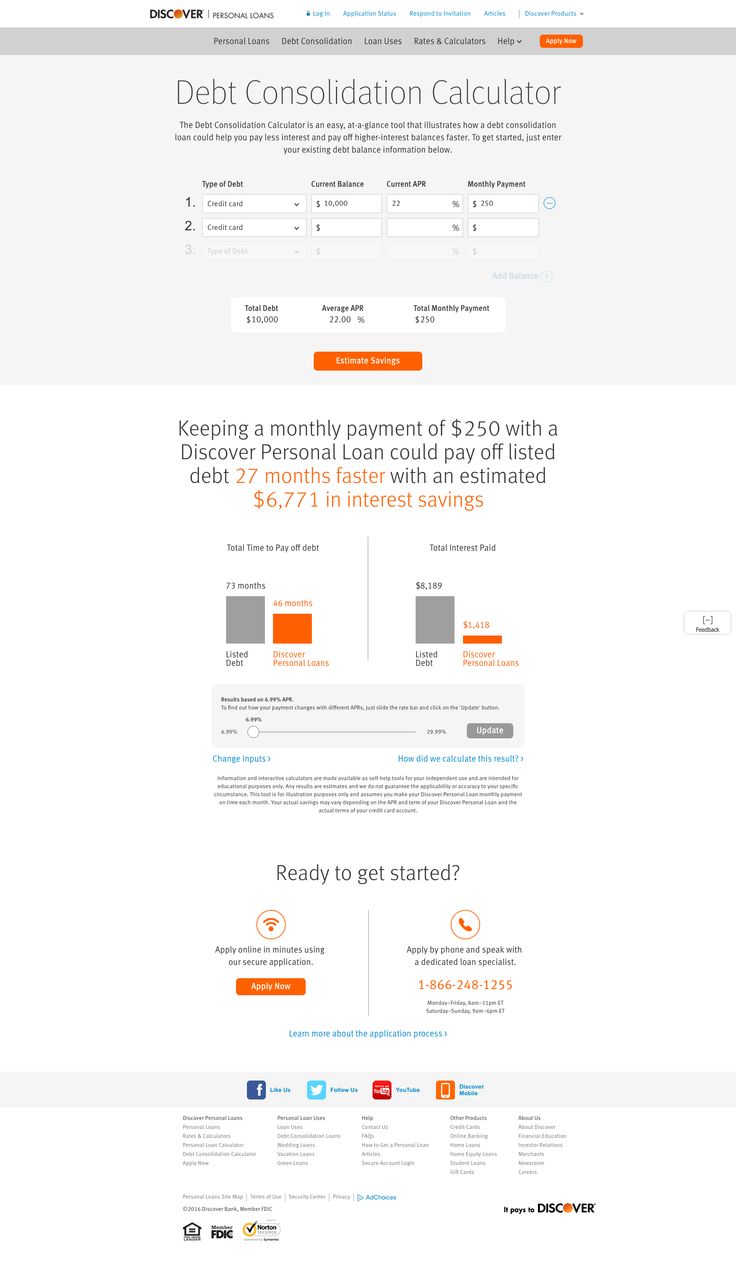

Bad credit debt consolidation loans are a great option for those who have poor credit and are struggling to pay their bills. While this loan will be more costly than a traditional one in the long term, it could help you save some money. Bad credit consolidation loans can be used to consolidate debt and lower your interest rates. Your credit report will be used by your lender to help you decide the terms of the loan.

Comparison of balance transfer and debt consolidation

Balance transfer and debt consolidation are two methods to solve a problem. The first method involves moving your debt from one card to another, usually one that offers lower interest rates. The balance transfer is when you use the funds on a different card to pay off your old balance. In both cases you'll need to budget your expenses to avoid getting into more debt.

Before you choose which option, make sure to do your research. A trusted lender should be able to provide details about their services and may even be licensed in your particular state. They will also have accredited and certified counselors. Finally, it is important to check with your state's attorney general or local consumer protection agency before making any final decisions.

Online lenders

There are many options for those with bad credit who need a consolidation loan to consolidate debt. You may only find lenders that specialize in this type or lending. They have very low minimum credit scores. Although a loan consolidation loan can be approved if your credit score falls below 600, the interest rate you will pay will likely be higher. You can check your credit score by using a free credit score monitoring tool at several banks.

It is a smart idea to shop around for the best rate. Get several quotes from debt consolidation loan companies, and then compare them. However, remember to avoid scams. You should watch out for red flags, such as aggressive sales representatives, "guaranteed" approvals, and quick-fix promises. Lenders that require upfront payments prior to loan approval should be avoided. A lender shouldn't ask for upfront fees and you should never pay by wire transfer or with a prepaid card.

Credit unions

Credit unions are a great option for people with bad credit. They are run by members and must conduct business responsibly. They may conduct a credit check on your behalf, much like a bank. They usually pull your credit history information from one of three major credit bureaus. The process may be complicated if there are any derogatory credit information. Credit unions frequently subscribe to ChexSystems Consumer Banking report.

Credit unions offer better terms than other banks or lending institutions for people with bad credit. These institutions operate by a cooperative model, and because of that, they're more likely to be lenient with terms. A personal loan from a credit cooperative typically has lower interest rates then a creditcard.

Secured loans

A secured loan is an excellent option if you have bad credit and are looking to consolidate debt. You can get a loan with a low interest rate based on your home equity. This type of loan will help you pay off all your other debts with a single monthly payment. A variety of lenders offer secured loans to consolidate bad credit debt. To find the best offer, you should shop around.

Although secured loans can be similar to unsecured loans they are subject to collateral. As long as the collateral is sufficient to cover the loan amount, you can use your home, car or savings account. The lender will be more willing to approve your loan application and offer you a favorable interest rate if the collateral is valuable enough to offset the risk.

Credit line for home equity

If you have high debt and want to consolidate it, a Home equity line of credit can help. This loan is secured by the home of the borrower and doesn't require a down payment. You will need a high credit score in order to be approved. Lenders require at least 680. Some lenders will allow you to apply even if you have lower scores. A lower income may require you to have less debt. These loans are subject to higher interest rates and have shorter terms than regular loans.

A home equity loan is secured by your home, so you should be prepared for the risk of missing payments. Failure to make payments could result in foreclosure which can cause you to lose your home. Additional costs such as closing costs or an appraisal may be required. It can take anywhere from thirty to sixty days for the application process.

FAQ

What are the top side hustles that will make you money in 2022

It is best to create value for others in order to make money. If you do this well, the money will follow.

While you might not know it, your contribution to the world has been there since day one. As a baby, your mother gave you life. Learning to walk gave you a better life.

If you keep giving value to others, you will continue making more. In fact, the more you give, the more you'll receive.

Value creation is a powerful force that everyone uses every day without even knowing it. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

Today, Earth is home for nearly 7 million people. This means that every person creates a tremendous amount of value each day. Even if only one hour is spent creating value, you can create $7 million per year.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. That's a huge increase in your earning potential than what you get from working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every day offers millions of opportunities to add value. Selling products, services and ideas is one example.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The ultimate goal is to assist others in achieving theirs.

Create value to make it easier for yourself and others. My free guide, How To Create Value and Get Paid For It, will help you get started.

What is the best passive income source?

There are many different ways to make online money. Many of these methods require more work and time than you might be able to spare. How do you find a way to earn more money?

Finding something you love is the key to success, be it writing, selling, marketing or designing. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

You might also think about starting a blog to earn passive income. Again, you will need to find a topic which you love teaching. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

There are many ways to make money online, but the best ones are usually the simplest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known content marketing.

How much debt can you take on?

It is essential to remember that money is not unlimited. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. So when you find yourself running low on funds, make sure you cut back on spending.

But how much is too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. You won't run out of money even after years spent saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

The key here is to pay off debts as quickly as possible. This includes student loans, credit card debts, car payments, and credit card bill. Once those are paid off, you'll have extra money left over to save.

It is best to consider whether or not you wish to invest any excess income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if you put your money into a savings account you can expect to see interest compound over time.

As an example, suppose you save $100 each week. Over five years, that would add up to $500. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. It's impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000 you would now have $57,000.

This is why it is so important to understand how to properly manage your finances. Otherwise, you might wind up with far more money than you planned.

How does a rich person make passive income?

There are two options for making money online. One way is to produce great products (or services) for which people love and pay. This is called "earning” money.

The second is to find a method to give value to others while not spending too much time creating products. This is called "passive" income.

Let's assume you are the CEO of an app company. Your job involves developing apps. You decide to give away the apps instead of making them available to users. It's a great model, as it doesn't depend on users paying. Instead, your advertising revenue will be your main source.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how most successful internet entrepreneurs earn money today. Instead of making things, they focus on creating value for others.

What is the distinction between passive income, and active income.

Passive income means that you can make money with little effort. Active income requires effort and hard work.

Your active income comes from creating value for someone else. If you provide a service or product that someone is interested in, you can earn money. This could include selling products online or creating ebooks.

Passive income allows you to be more productive while making money. Many people aren’t interested in working for their own money. They choose to make passive income and invest their time and energy.

Passive income doesn't last forever, which is the problem. If you wait too long before you start to earn passive income, it's possible that you will run out.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. So it's best to start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types of passive income streams:

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate includes flipping houses, purchasing land and renting properties.

Which side hustles have the highest potential to be profitable?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types of side hustles: passive and active. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles are smart and can fit into your life. Consider starting a business in fitness if your passion is working out. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles can be found anywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you're an experienced writer so why not go ghostwriting?

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. So when an opportunity presents itself, you will be prepared to take it.

Side hustles aren’t about making more money. They're about building wealth and creating freedom.

There are so many ways to make money these days, it's hard to not start one.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to make money at home

It doesn't matter how much money your online business makes, there is always room for improvement. But even the most successful entrepreneurs struggle to grow their businesses and increase profits.

It's easy to get lost in a rut when you start a business. Instead of focusing on growing your company, you can focus only on increasing revenue. You may spend more time on marketing rather than product development. You may even forget about customer service.

You need to assess your progress on a regular basis and decide if your results are improving or just maintaining the status. These are five ways to increase your income.

-

Increase your Productivity

Productivity is more than just the output. You must also be efficient at completing tasks. Delegate the tasks that require the most energy and effort in your job to others.

For example, if you're an eCommerce entrepreneur, you could hire virtual assistants to handle social media, email management, and customer support.

Another option is to assign one person to write blog posts and another to manage lead-generation campaigns. When delegating, choose people to help you achieve your goals faster and better.

-

Focus on Sales instead of Marketing

Marketing doesn’t always have to mean spending a lot. Some of the best marketers aren't paid employees at all. They are consultants who work for themselves and earn commissions based upon the value of their services.

Instead of advertising products on television, radio and in print ads, consider affiliate programs that allow you to promote the goods and services of other businesses. For sales to be generated, you don’t need to buy expensive inventory.

-

Hire an Expert To Do What You're Not Able to

If you lack expertise in certain areas, hire freelancers to fill the gaps. Hire a freelance designer to create graphics on your site if you aren’t an expert in graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be tedious when you work as an independent contractor. It can be particularly tedious if you have multiple customers who want different things.

FreshBooks and Xero are two apps that make it simple to invoice customers. You can easily enter all the client information and send them invoices through the app.

-

Promote More Products with Affiliate Programs

Because affiliate programs allow you to sell products without having to keep stock, they are great. And you don't need to worry about shipping costs either. It's easy to set up a link from your website to the vendor's. You will then receive a commission every time someone purchases something from the vendor. Affiliate programs can help build a reputation and increase your income. If you can provide high-quality content and services, you will attract your audience.