If you're interested in a Lending Club loan, there are a few things you should know before making a decision. These include the following: Repayment, Credit score (or credit score), Origination fee and review. Continue reading to find out more. Lending Club loans offer a great solution for individuals who are looking for a quick and easy loan.

Review

Lending Club was a peer to-peer lending platform that removed the banker from the loan process. Its website allowed investors to lend to borrowers, setting the interest rate on each loan. This company is a success because it offers investors great returns while allowing borrowers to access fast funds at attractive interest rates. It is important to research any investment opportunity before you invest.

Lending Club loans are subject to an interest rate that is determined by the borrower’s current credit score. The borrower’s debt-to income ratio, credit score and credit activity determine the loan grade. If a borrower has a bad credit score, the loan grade will be lower.

Repayment

When you have a LendingClub account, you can start repaying your loan in as little as one month. The principal and interest of your loan will be automatically credited to your account when you make a minimum monthly payment. All fees related to receiving payments will be also credited to your account. You don't need to worry about missing payments.

Once you have paid off the loan, you can move forward with your financial life. You can use the money from your account to repay other loans and other debt. The money will be transferred to your bank account.

Credit score

Before applying for a loan, it is essential to understand your credit score. Thankfully, Lending Club has a streamlined process for applying for a loan. The best part is that you do not need to be a member of the company to apply. Lending Club offers borrowers an "Check Your Ratio" option. It uses a soft pull on borrowers credit to help them determine whether they are eligible for the loan and if they need a cosigner.

Look at your most recent credit reports to determine what level of risk you are. Lending Club offers a risk assessment which includes your FICO score. Your score will then be calculated and assigned a risk rating from A to G5. Lending Club also assigns each letter grade a numerical rank. Lending Club will perform a risk assessment and also evaluate your income and credit history. A borrower with an income range of $90,000-$100,000 will likely receive the best terms. Even borrowers who do NOT meet the required criteria can still qualify to receive a rate that is favorable if they are able to find a cosigner.

Origination fee

LendingClub, one of the most popular P2P lending platforms in America, is LendingClub. It has been in dispute with Federal Trade Commission over charging origination fees for loans. This company will stop offering these services as of December 2020 and instead focus on its full-spectrum fintech market bank.

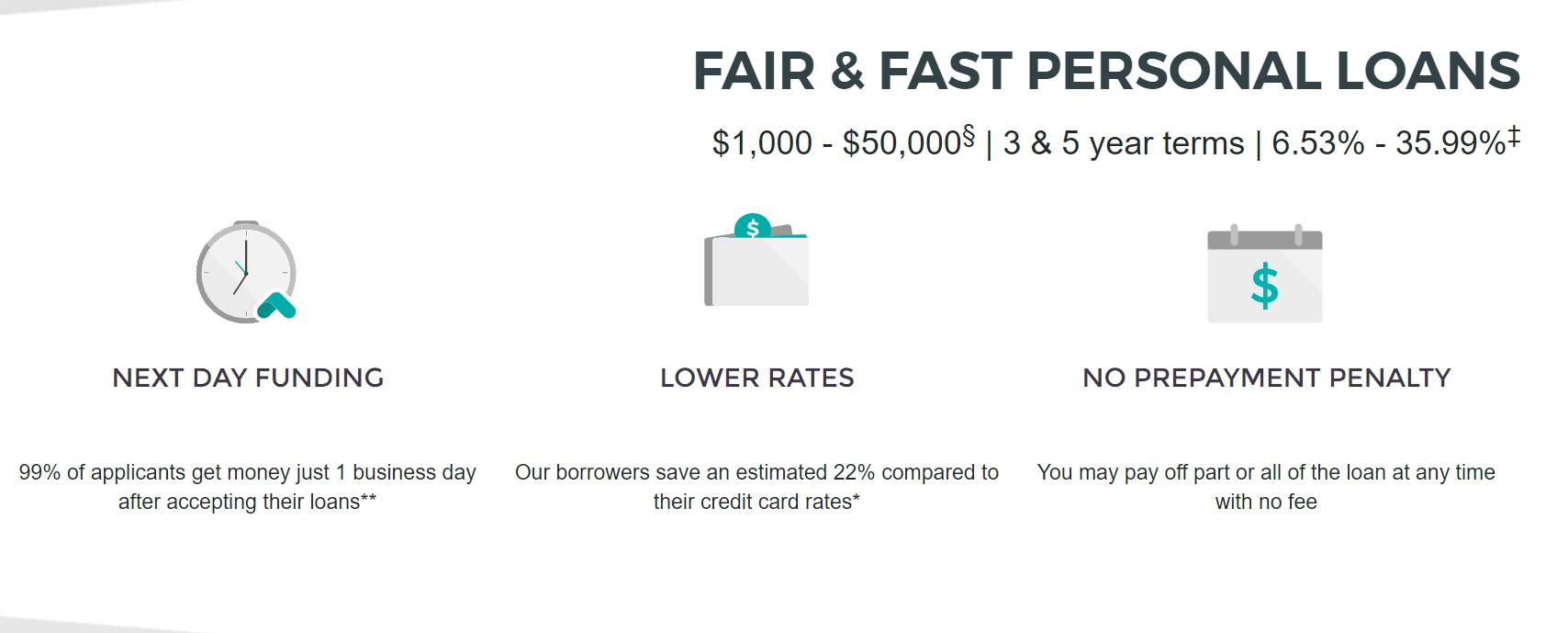

In general, personal loans have an origination charge of between 1% and 6% of their loan amount. Other fees could include a prepayment penalty, late fees, and fees for late payments. These fees do not have to be paid upfront. However, late fees will be charged for payments that are more than 15 calendar days late.

Approval process

Lending Club is an online peer-to–peer lender that connects borrowers to investors. The site provides financial information to members and loans at a lower interest rate than traditional banks. Lending club also offers loan servicing, underwriting, and mortgage servicing. Members can borrow money from the club or invest in loan portfolios, at interest rates higher than those of savings accounts. To become a member, applicants must be at least 18 years old, have a valid bank account and social security number, and be a U.S. citizen. Minimum credit score is 660

LendingClub loan applicants need to submit a complete online application. They should include pay stubs, a photo ID, and recent utility bills and bank statements. Borrowers should expect a decision within 24hrs after submitting their application. Borrowers can access the status of the loan on the website once they are approved.

FAQ

What is the best passive income source?

There are many online ways to make money. Some of these take more time and effort that you might realize. How can you make extra cash easily?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a list with 101 tips and resources for affiliate marketing.

You might also think about starting a blog to earn passive income. This time, you'll need a topic to teach about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

Although there are many ways to make money online you can choose the easiest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you have created your website, share it on social media such as Facebook and Twitter. This is content marketing. It's an excellent way to bring traffic back to your website.

What's the difference between passive income vs active income?

Passive income can be defined as a way to make passive income without any work. Active income requires effort and hard work.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because you can focus on other important things while still earning money. Most people aren’t keen to work for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

Problem is, passive income won't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

It is possible to burn out if your passive income efforts are too intense. You should start immediately. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types of passive income streams:

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate includes flipping houses, purchasing land and renting properties.

Which side hustles are most lucrative?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Side hustles that are active include tutoring, dog walking, and selling products on eBay.

Side hustles that work for you are easy to manage and make sense. If you love working out, consider starting a fitness business. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles are available anywhere. Side hustles can be found anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Maybe you're a writer and want to become a ghostwriter.

Do your research before starting any side-business. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles are not just about making money. They're about building wealth and creating freedom.

And with so many ways to earn money today, there's no excuse to start one!

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. It is important to establish a good reputation online as well offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. It is important to consider how you can help the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many ways to make money online.

But when you look closely, you can see two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its pros and cons. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. These gigs are also highly competitive.

Consulting allows you to grow and manage your business without the need to ship products or provide services. It takes more time to become an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. It takes some trial and error. But it will pay off big in the long term.

How to build a passive income stream?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

It means listening to their needs and desires. You need to know how to connect and sell to people.

The next step is to learn how to convert leads in to sales. Finally, you must master customer service so you can retain happy clients.

You may not realize this, but every product or service has a buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

To become a millionaire takes hard work. To become a billionaire, it takes more effort. Why? To become a millionaire you must first be a thousandaire.

Finally, you can become a millionaire. You can also become a billionaire. The same is true for becoming billionaire.

So how does someone become a billionaire? It starts by being a millionaire. You only need to begin making money in order to reach this goal.

However, before you can earn money, you need to get started. Let's discuss how to get started.

How does a rich person make passive income?

There are two options for making money online. One is to create great products/services that people love. This is called earning money.

Another way is to create value for others and not spend time creating products. This is called "passive" income.

Let's imagine you own an App Company. Your job is developing apps. You decide to give away the apps instead of making them available to users. It's a great model, as it doesn't depend on users paying. Instead, you can rely on advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is the way that most internet entrepreneurs are able to make a living. They are more focused on providing value than creating stuff.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to Make Money Online

It is much easier to make money online than it was 10 years ago. It is changing how you invest your money. There are many ways you can earn passive income. However, some require substantial upfront investment. Some methods are more difficult than others. There are a few things to consider before you invest your hard-earned money into any online business.

-

Find out what type of investor are you. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. Research is essential before you make any commitment to any program. Look through past performance records, testimonials, reviews. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not rush to tackle a huge project. Instead, begin by building something basic first. This will enable you to get the basics down and make a decision about whether or not this type of business is for your. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too early to begin making money online. Even if you have been working full-time for years you still have time to build a strong portfolio of niche websites. All you need are a great idea and some dedication. Now is the time to get started!